What separates a thriving property portfolio from one that struggles? The answer often lies not in the deals you find but how you think about them, and your mindset could be the deciding factor between seizing opportunities or watching them pass by. In this guide, we’ll explore how developing an investor’s mindset—grounded in strategic thinking and timeless wisdom—can help you see beyond the obvious and invest with confidence. Ready to reshape how you approach property investment?

WHAT IS AN INVESTOR’S MINDSET

Stephen R. Covey’s famous line, “We see the world, not as it is, but as we are,” perfectly sums up mindset. Our mindset is the lens through which we see everything, it shapes our assumptions, expectations, and ultimately, the outcomes of our efforts. Experts emphasise how, when unchecked, our mindset can lead to less-than-ideal results. Yet the more we understand it, the better our chances are to shift it and align it with ways of thinking that take us above challenges and closer to our desired outcomes.

The investor’s mindset refers to a set of views and thought patterns guiding investment decisions. This is the frame of mind that focuses on long-term perspective, analytical thinking, and a balanced approach to risk and reward.

In practice, an investor’s mindset isn’t about making quick profits or blindly following market trends. Instead, it’s about making informed, strategic decisions based on thorough research and clear investment goals.

TOP 10 INVESTING QUOTES TO INSPIRE YOUR PROPERTY JOURNEY

Wisdom from successful investors can provide valuable insights and motivation for all investment journeys, and for property enthusiasts, that’s not much different. Inspired by ten timeless investment quotes, here is how I see these principles in action:

1. “The most important quality for an investor is temperament, not intellect.” – Warren Buffett

This quote reminds us of the importance of emotional control in investment—how crucial it is to maintain a level head and not let emotions drive your decisions.

- Action: Understand the emotion-driven cycles of investing and design a strategy to guide your decisions during volatile or difficult times. For instance, include a plan to exit and enter the market when the conditions are right. This will help you maintain a balanced perspective instead of panicking during market downturns or getting overly excited during booms.

2. “Don’t wait to buy real estate. Buy real estate and wait.” – Will Rogers

This highlights the long-term nature of property investment and the potential for appreciation over time.

- Action: Adopt a long-term perspective in your strategy. For example, consider properties with potential for long-term appreciation and steady cash flow in your portfolio. While quick profits through rapid buying and selling is a valuable approach given the right circumstances, a diversified portfolio is a strategy for risk mitigation.

3.“The big money is not in the buying and selling, but in the waiting.” – Charlie Munger

Another quote emphasises the importance of patience and a long-term outlook —both crucial for property investments like Houses in Multiple Occupation (HMOs,) where returns are maximised over time.

- Action: Focus on sustainable growth strategies and avoid knee-jerk reactions to short-term market fluctuations.

4. “Buy land, they’re not making it anymore.” – Mark Twain

While not strictly an investor, Twain’s quote highlights the value of real estate as a finite resource.

5. “The best investment on Earth is earth.” – Louis Glickman

This simple statement captures the enduring value of property as an investment asset. Twain’s and Glickman’s quotes highlight the fundamental appeal of real estate.

- Action: Recognise the inherent value of property. Remember that well-chosen properties in good locations tend to appreciate over time due to their scarcity and utility.

6. “Real estate investing, even on a very small scale, remains a tried and true means of building an individual’s cash flow and wealth.” – Robert T. Kiyosaki

Kiyosaki’s quote underscores how real estate investing works for everyone, not just large-scale investors. Even small investments, when managed well, can create long-term wealth. It also subtly suggests that consistency matters more than the size of investment.

- Action: Leverage the full potential of property investment and consistency. As you plan your investment strategy, consider the diverse ways to build wealth through real estate, i.e., capital appreciation, rental income, tax benefits, and the different schemes, from Buy-To-Let (BTL) to Buy-Refurbish-Refinance-Rent and holiday lets, to grow your property portfolio.

7. “In investing, what is comfortable is rarely profitable.” – Robert Arnott

We’ve heard it countless times: growth happens outside the comfort zone.

- Action: Be prepared to step out of your comfort zone and be willing to consider different types of properties and locations to invest in property. For example, suppose you’ve only invested in BTL, you might explore commercial real estate, flipping a house into flats, or title-split—not only will you improve your chances for significant returns, but you will also lower the risk of relying on a single market.

8.“Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world.” – Franklin D. Roosevelt

A reminder of the tangible and lasting nature of property investment—and the relevance of strategy and efficient management.

- Action: Incorporate thorough due diligence into your investment strategy. Before purchasing, always conduct comprehensive research on the property, its location, and market conditions, all through the lens of your financial profile. Once you own properties, manage them diligently to protect and enhance their value.

9. “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” – Warren Buffett

Buffett’s “gold bucket” encourages investors to be ready to act decisively when good opportunities arise.

- Action: Be ready to seize opportunities. In property investment, this implies having capital prepared to move quickly once you see an opportunity with potential. Still, it also means staying watchful of market trends and building a network of contacts who can alert you, for example, to off-market deals.

10.“Do not put all your eggs in one basket.” – Warren Buffett

Diversification is critical in managing investment risks. This is the principle behind spreading investments across various property types, locations and other investment venues and instruments.

- Action: Balance your portfolio by investing in different property schemes. Consider, for example, co-living, serviced accommodations and property stocks, and shares. This spread will help you mitigate risks associated with any single market segment.

While these quotes generally encourage property investment, it’s essential to remember the principle of diversification. Consider how property and each asset fits into your overall investment portfolio and financial goals.

DO YOU HAVE THE RIGHT MINDSET FOR PROPERTY INVESTMENT?

In property investment, having the right mindset is as important as having suitable properties in your portfolio. Cultivating an investor’s mindset means we see properties as assets with potential for growth and income generation, looking beyond the surface to understand what influences property values and rental yields.

However, this mindset also implies that we actively cultivate the habits that enable us to remain calm and rational when it’s most needed:

- Evaluate opportunities more objectively, considering both potential risks and rewards.

- Stay focused on your long-term goals, even during market downturns.

- Make decisions based on facts and analysis rather than emotions.

- Adapt to new conditions and find opportunities rather than obstacles.

- Put time into continuing learning and staying updated on market trends, regulations, and new investment strategies.

For HMO investors and landlords, developing this mindset is particularly crucial. The HMO market is complex, with enhanced regulations and demanding management responsibilities. Yet the rewards and potential for high returns are similarly greater, and an investor’s mindset will help you navigate these challenges more effectively.

THE CHALLENGE: RECOGNISING AND OVERCOMING INVESTOR BIAS

Who is to blame for the bad choices we make? In Harvard’s publication, The Hidden Traps in Decision Making, the authors explain how bad decisions can be traced back to a lack of clarity, inadequate information or misjudging the costs and benefits, yet sometimes the problem isn’t the process but the “mindset of the decision maker”—i.e. the way our brain operates can undermine our choices.

Imagine for a moment an investor that makes a call based solely on a feeling rather than reasoning—say with a naïve view of an “opportunity” just because it appears after a series of good investment results. This shortcut, Gambler’s fallacy, can lead to increased risk by ignoring information critical for an effective assessment.

The trap we all must avoid involves relying on flawed shortcuts or assumptions—known as bias—often leading to irrational or poor decision-making. These biases distort how we view information, evaluate risks, and, ultimately, how we act.

WHAT IS INVESTOR BIAS?

Investor bias refers to deep-seated patterns of thinking, or mental shortcuts, that can cloud judgment and lead to suboptimal investment decisions instead of well-reasoned strategies—all this, typically without the investor even realising it.

In the property market, investor bias can manifest in various ways. Understanding how these patterns play out can help you a) recognise when your decisions are influenced by things other than objective analysis, b) take steps to counteract these biases and c) make more balanced and potentially more profitable choices.

COMMON INVESTOR BIASES FOR LANDLORDS TO AVOID

While not all mental shortcuts are damaging—and intuition based on experience can be a valuable resource in investment, we want to strike a balance. By recognising common biases and actively working to counteract them, you can develop a more rational, strategic approach to property investment. Can you identify any of these patterns?

- Confirmation bias occurs when we seek out information that supports our existing beliefs while ignoring contradictory evidence. For example, you could be focusing solely on positive reviews of an area you’re interested in, overlooking potential drawbacks.

- Anchoring bias is our tendency, when making decisions, to rely too heavily on the first piece of information obtained. This might mean fixating on the first valuation you receive in property, even if further research suggests it’s wrong.

- Loss aversion bias might lead us to prefer avoiding losses over acquiring equivalent gains. For example, holding onto an underperforming property for too long, fearing the loss more than the potential gains from reinvesting elsewhere.

- Herd mentality involves following the crowd rather than making independent decisions. In property, this bias might lead to piling into ‘hot’ areas without proper due diligence.

- Overconfidence bias is the shortcut at play when we overestimate our abilities, and it can lead to excessive risk-taking. It might result in overleveraging or neglecting research before making investment decisions.

- Gambler’s fallacy is a cognitive bias that makes you assume that what happened before can change what happens next. It basically describes a disposition to believe that a “positive strike” will continue even though we know each investment decision is independent.

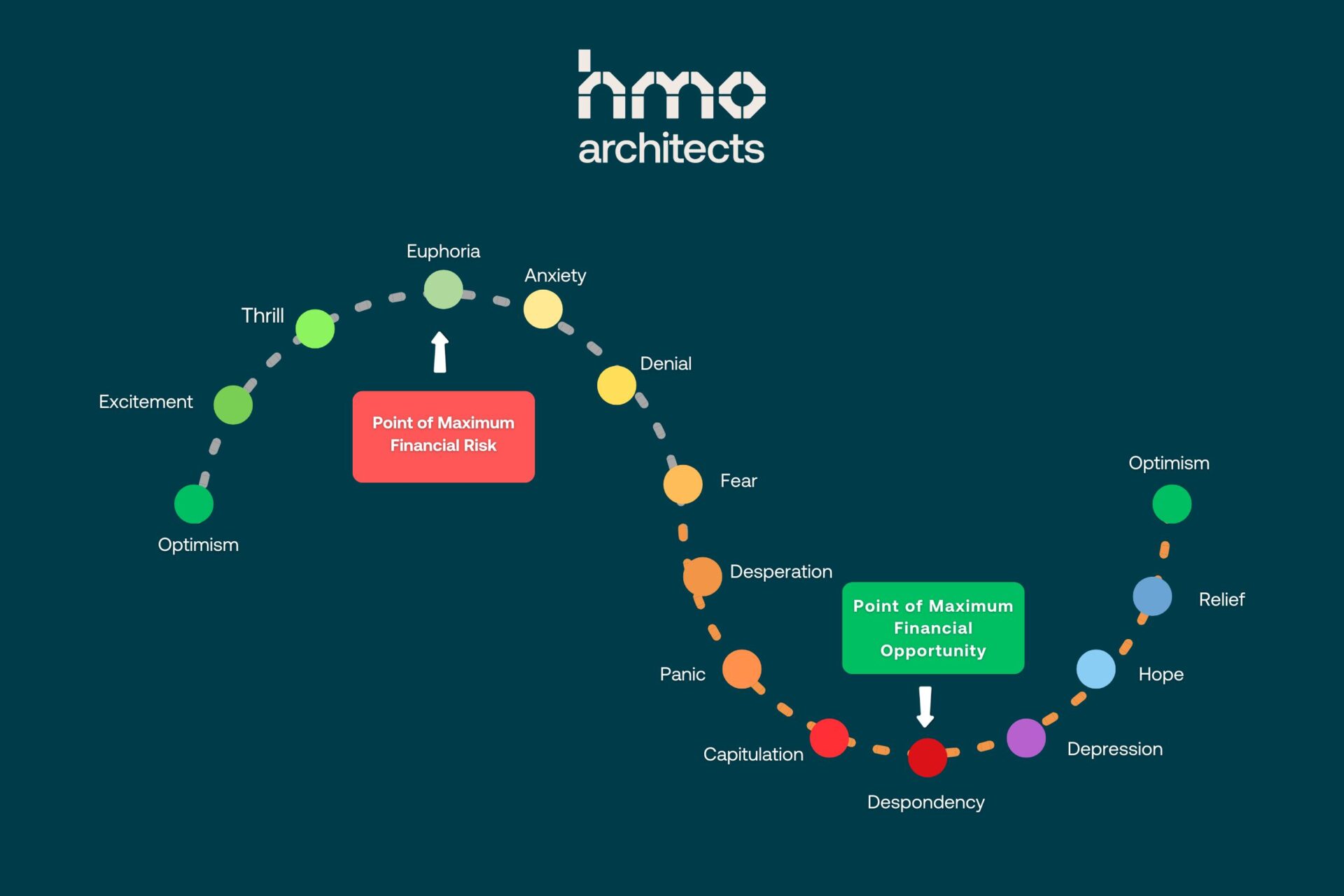

INVESTOR’S PSYCHOLOGY GRAPH

HOW TO THINK LIKE AN INVESTOR: 7 STRATEGIES TO REDUCE BIAS

Developing strategies to reduce bias is vital to develop an investor’s mindset. There is a wealth of resources and tools (designed by field experts) to help us recognise and counter our maladaptive shortcuts, dealing with the emotional, social and mental factors influencing investors’ psychology, but let me share my top practical approaches:

- Seek different perspectives by actively looking for viewpoints that challenge your own. Engage with property experts, from estate agents to surveyors, developers and fellow investors. This can help balance your views and reveal blind spots in your thinking.

- Base your investment decisions on solid data rather than gut feelings or hearsay. Local property price trends, rental yields, and demographic data are some of the most valuable resources to inform your choices.

- Before making any investment, conduct comprehensive research. This includes property inspections, market analysis, and financial modelling to assess potential returns and risks.

- Implement a system for evaluating properties. For example, developing your own comprehensive checklist can help you stay on track in your assessment and consider all relevant factors consistently. At the end of the day, you don’t want one standout quality to sway your decision.

- Practice scenario planning before investing. You want to consider several potential outcomes, for example, best-case, worst-case, and most likely scenarios. This can help you prepare for various possibilities and make more balanced decisions when the time comes.

- Set specific, measurable criteria for your investments before you start looking at properties. This can help you evaluate opportunities objectively and avoid emotional or impulsive factors from biasing your decision.

- Review and rebalance your portfolio periodically. Ask yourself if, based on current market conditions and your goals, you would make the same investment decisions today.

There is no shortcut to overcoming bias; this is an ongoing process for all of us in any field. Even experienced investors will need to check their assumptions and decision-making processes regularly. See this process as part of your strategy—the aim is to build a robust, profitable property portfolio, getting better at spotting genuine opportunities and managing risks effectively.

HOW TO ACT LIKE AN INVESTOR: 7 STRATEGIES TO SHARPEN YOUR MINDSET

Developing an investor’s mindset is an ongoing process, but with dedication and practice, it is within reach. Here are some practical tips to make it happen.

PRACTICAL TIPS TO DEVELOP THE INVESTOR’S MINDSET

- Educate yourself continuously and keep an eye on market trends, economic indicators, and changes in property regulation. The more knowledge you gain, the better equipped you’ll be to make informed decisions—and reduce the risk of falling into biased thinking or making emotion-based choices.

- Attend property webinars and retreats or seminars to gain valuable insights from industry experts and successful investors. Seize all opportunities to learn about investment strategies and market developments.

- Subscribe to property investment newsletters for market updates, investment tips, and analysis by experts. These can be a great way to stay informed with minimal time investment.

- Familiarise yourself with tools and platforms that provide information on property prices, rental yields, and market trends. Learning to interpret this data can significantly enhance your decision-making process.

- Follow reputable property market analysts on social media or blogs to understand performance and predictions about the market.

- Learn how broader economic factors like interest rates, employment rates, and GDP growth can impact the property market. This macro-level understanding can help you anticipate market shifts.

- Keep an eye on local news and council plans in areas where you’re investing or considering investing. New infrastructure projects, zoning changes, or large employers moving in or out can significantly impact property values.

GET IN TOUCH TODAY TO ADVANCE YOUR PROPERTY INVESTMENT JOURNEY

If you haven’t already, you’re likely beginning to see how adopting the mindset and habits of seasoned investors can transform your approach to property investment. These insights are powerful but must be tailored to your unique situation, goals and risk profile. Whether you’re just starting out or already expanding your portfolio, success comes from knowledge and partnering with the right team.

We’re here to help you build a solid strategy and provide the support you need. Let’s take your journey to new highs, reach out today to discuss your investment strategy. Not there yet? Book a free discovery call for your project or claim your free lessons for beginner investors. Like you, we are deeply invested in property.

Ryan Windsor, Development Director and co-founder of HMO Architect, brings over 15 years of specialised experience in HMO development to the table. Having consulted on nearly 2,200 projects, Ryan is a highly seasoned HMO landlord with a vast and influential property network. He began his real estate journey at just 17, rapidly amassing a wealth of experience that sets him apart in the industry. Beyond his professional successes, Ryan is passionately dedicated to giving back, leading numerous charitable initiatives that make a meaningful impact on local communities.