Are you looking to take control of your financial future with a tangible, income-generating asset? Buy to Let (BTL) presents a unique opportunity for investors to benefit from rental income and capital appreciation. The appeal of BTL lies in its stability and the control it offers over your investment. However, a thriving BTL requires knowledge and strategic planning. What are the steps to becoming a successful BTL investor, and how can you mitigate the risks? Discover the fundamentals of Buy to Let, from understanding market dynamics to financing and managing properties effectively.

WHAT IS BUY TO LET

Buy to Let (BTL) is an investment strategy that involves purchasing property to rent it out to tenants as a single AST (assorted single tenancy). It’s a popular approach among investors looking to generate a steady income stream from rental payments and long-term property appreciation.

The beauty of BTL lies in its dual return potential: immediate cash flow from monthly rents and the promise of substantial returns when you eventually sell the property. BTL is a compelling option for many investors, offering both a tangible asset and the potential for significant passive income—provided you manage the property well.

Understanding BTL Basics

Successfully executing a BTL strategy requires a thorough understanding of financials, marketing and managing rental properties. You need to navigate mortgage arrangements, manage the property effectively, acquire reliable tenants, and adhere to all legal responsibilities as a landlord.

Investing in BTL starts with purchasing a property in a location with strong rental demand. Investors typically target areas based on good transportation links, local amenities, and employment opportunities to attract potential tenants.

The financial side of BTL involves securing a buy-to-let mortgage —a product specifically designed for rental properties. Unlike standard residential mortgages, BTL mortgages often require a larger deposit and have higher interest rates, reflecting the added risk associated with rental properties.

How Does Buy To Let Work: The Mechanics of BTL Investing

The BTL investment strategy involves a series of calculated steps:

- Market Research: Start by identifying a promising property in a location with high rental demand.

- Financing: Once you have found a suitable property, you must secure financing through a buy-to-let mortgage, specifically designed for property investors rather than homebuyers.

- Refurbish: After purchasing the property, refurbish or renovate it to attract potential tenants and comply with legal standards for rental properties.

- Management: The next step involves marketing the property to find tenants (initially and as needed) and managing the rental process, from collecting rent and scheduling maintenance to handling any issues with the property or tenants.

- Income and Appreciation: The ultimate goal is to generate a steady stream of rental income and benefit from the property’s appreciation over time.

- Scaling Up: A possible next stage is to explore growing your property portfolio, which can take different routes. The BRRRR (buy, refurbish, refinance, rent, repeat) model is one such route.

Getting Started with BTL

Can You Buy To Let as a First-Time Buyer?

Taking on a BTL investment as a first-time buyer is entirely possible. Many first-time buyers are attracted to property investment because of the potential for rental income and capital appreciation. However, securing a buy-to-let mortgage as a first-time buyer can be more complex than for those who already own or have owned a property.

Lenders typically see first-time buyers as higher risk, especially if they do not own their own home. As a result, the criteria may be stricter, and the choice of lenders and mortgage products might be more limited.

First-time buyers must demonstrate strong financial stability, good credit scores, and sufficient income to cover mortgage payments during potential rental voids. Additionally, they should be prepared to manage the property and tenants, requiring a commitment to comply with landlord responsibilities and legal requirements.

Utilising ISAs and Other Financial INSTRUMENTS for BTL

Individual Savings Accounts (ISAs), particularly the Lifetime ISA, are popular savings vehicles due to their tax efficiency. However, it’s important to note that Lifetime ISA is primarily designed to help first-time buyers purchase their homes or save for retirement, not for buy-to-let investments —withdrawals for other than these incur a penalty, typically a 25% charge on the amount withdrawn.

There are financial tools that are more appropriate for BTL investments. These include using a standard Cash ISA or Stocks and Shares ISA to save for a deposit, as these do not restrict how you may use the saved funds. Specific property investment funds or Real Estate Investment Trusts (REITs) can also be part of a broader investment strategy. Such products expose you to property markets without needing to manage physical properties.

While ISAs provide excellent tax-free money-saving mechanisms, they are generally unsuitable for direct investment into buy-to-let properties unless used strategically for accumulating initial capital. Investors resort typically to other financing options tailored for investment, such as buy-to-let mortgages.

How Buy To Let Mortgages Work

As mentioned, BTL mortgages are instruments designed for investors looking to purchase properties to rent out. Unlike standard residential mortgages —tied up with an applicant’s income and creditworthiness— BTL mortgages are primarily assessed based on the potential rental income the property can generate.

Lenders will evaluate the expected rental income to ensure it exceeds the mortgage payments by a certain percentage. Commonly, this is around 125% to 145% of the mortgage payment at an interest rate often calculated at a ‘stress rate’ higher than the actual rate to ensure investors can cover payments even if rates rise. This assessment method highlights the importance of choosing properties in areas with strong rental demand to secure favourable mortgage terms.

BTL mortgages usually require a larger deposit than residential mortgages, often ranging from 20% to 40% of the property’s purchase price, reflecting the risk associated with rentals. These mortgages can be interest-only, where the borrower pays just the interest each month, or repayment, where part of the capital is also paid down.

Measuring Your Borrowing Capacity

Figuring out how much you can borrow for a buy-to-let mortgage is vital in planning your investment. Several factors influence your borrowing capacity:

- Rental Coverage Ratio: Lenders will assess the rental income the property will generate. This must be a realistic figure for the monthly rent you expect to charge, substantiated by similar rentals in the area. The income typically must cover 125%-145% of the mortgage repayments at a higher ‘stress’ interest rate.

- Deposit: The size of your deposit significantly affects how much you can borrow. Generally, the more you can put down upfront, the less risk for the lender, and potentially, the better the mortgage terms offered. A larger deposit can also lead to a lower interest rate.

- Investor’s Financial Health: Lenders will also take your financial situation into account, including credit score, existing debts, and other financial commitments. A solid financial standing can improve borrowing capacity.

- Property Value: The type and condition of the property can also impact how much you can borrow. Properties deemed a good rental investment are more likely to secure higher borrowing amounts.

Future BTL investors should speak with mortgage advisors or brokers specialising in this area to get a precise picture of how much they can borrow. The aim is to ensure you look at properties aligning with your financial capacity and investment strategy.

BTL Financial Considerations

Entering the BTL market demands a keen understanding of the financial complexities, especially for new investors. To recap, borrowing for BTL typically means the deposit is more significant than that for residential, and loans are based on the potential rental income and operate at higher interest rates and fees.

Investors must also account for other financial factors such as landlord insurance, property maintenance costs, potential periods without tenants (void periods), and compliance with rental property standards, which can involve additional expenditure.

Managing all financial commitments effectively is critical to making a BTL investment successful and profitable.

Legal and Regulatory Considerations

Stamp Duty Implications for BTL Investors

Additionally to the standard stamp duty land tax (SDLT) charged on property purchases, BTL investments attract an additional surcharge. If you’re buying an extra property, like a holiday home or for investment purposes, you’ll need to factor a further 3% SDLT on top of the regular rates for each price band. This surcharge applies to the entire property price.

This additional surcharge on BTL properties is designed to cool the housing market and level the playing field for first-time buyers against investors purchasing homes. You must factor this surcharge into your financial planning, as it can significantly impact the overall investment cost and budget.

Residency Rules: Can You Live in Your BTL Property?

New property investors frequently question whether living in a property purchased as a BTL is allowed. In short, this is likely to be against the terms set by mortgage lenders. BTL mortgages are based on the agreement that tenants occupy the property and not use it as the owner’s residence.

A property owner living in a BTL property is generally a breach of terms and can be considered mortgage fraud. Depending on the official agreement:

- The lender may demand immediate repayment of the mortgage or change the loan conditions, which can lead to increased interest rates or financial penalties.

- In some cases, the lender could start legal proceedings for breach of contract.

- Insurance policies on BTL properties also assume the property is rented to tenants. The owner living in the property could invalidate the insurance coverage, leaving the investment unprotected.

When circumstances change, and the owner needs to live in a BTL property, the advised route is first to consult the mortgage lender to discuss converting the BTL mortgage into a residential one.

Comparing BTL with Other Property Investments

BTL and Houses in Multiple Occupation (HMO) are popular property investment strategies with unique characteristics and potential benefits. The choice between BTL and HMO depends on several factors, including your investment goals and willingness to manage multiple tenants.

BTL vs HMO: What’s Best for Your Portfolio?

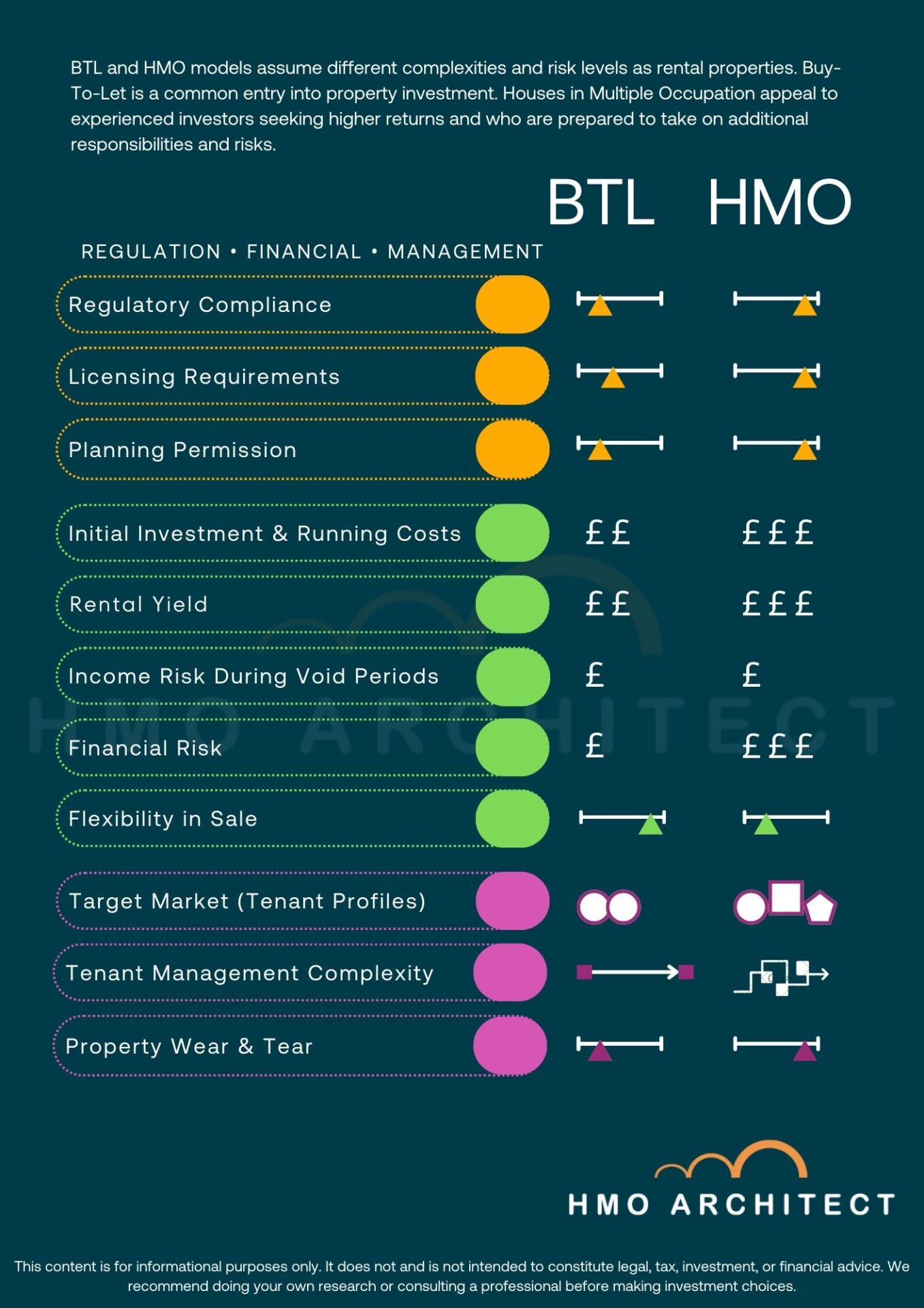

BTL and HMO models assume different complexities and risk levels as rental properties. BTL might be preferable for those looking for a more straightforward entry into property investment. On the other hand, the HMO rental could be suitable for more experienced investors seeking higher returns and who are prepared to take on additional responsibilities.

Buy to Let (BTL) involves purchasing the property and renting it out as a single let to individuals or families. The main advantage of BTL is its simplicity relative to HMO. The regulations are generally more straightforward, and managing one tenant or family involves less complexity than managing multiple tenants. BTL can often be a hands-off investment, mainly if handled by a letting agency.

Houses in Multiple Occupation (HMO) involve renting out individual rooms within a property to multiple tenants who share common facilities like the kitchen and bathroom. HMOs can offer higher rental yields due to multiple income streams from the same property. However, they also require more intensive management, including dealing with higher tenant turnover and adhering to stricter regulatory requirements, such as fire safety standards and minimum room sizes. Additionally, HMO mortgages tend to have different criteria and can be more challenging to obtain than standard BTL mortgages, often requiring investors to have prior experience in property management.

Investment Outcomes: Single Let VS HMO

HMO and single-let properties each have distinct financial dynamics and operational demands. Here, we discuss three popular plans which might suit your ambitions as a prospective BTL landlord.

SINGLE FAMILY LET: YIELD AND RISKS

By renting to one family alone, you will have fewer tenants for yourself or your agent to manage, generally demanding far less work. Start-up expenses are typically lower as the property won’t need repurposing or change of use from C3 (residential) to C4 (HMO). In most cases, single-family lets are easier to sell given the appetite for ‘traditional’ homes, and they have higher appreciation in property value, particularly in desirable locations.

A traditional single let can provide a more predictable income stream with generally lower management. They also tend to attract longer tenancy agreements (e.g. families), which can mean less frequent tenant turnover and potentially lower maintenance costs over time.

However, the trade-off is usually lower rental yields than HMOs—gross yields differ dramatically from region to region. Still, you’d expect an average of 7.44% in Liverpool and 4.79% in Oxford. Notably —and in contrast to HMOs— by receiving all your rent and bills from one source, you assume a far greater risk with void periods leading to zero rental income.

Expected rental yield from a single-family home? Nat West states anything over 6% can be considered ‘very good’.

HMOs: YIELD AND RISK

The initial outlay with HMOs can be significant as you’ll required to furnish the property, including each bedroom and shared area. Budgets often involve refurbishments to meet legal standards, such as HMO Licensing, and the ongoing costs of managing multiple tenancies and responsibilities, like fire testing and maintenance. HMOs’ cash flow can also be more variable due to potentially higher tenant turnover.

However, HMO rental yields can reach far beyond those from a single-family unit, given the number of occupants paying rent from a single property. This can be particularly advantageous in high-demand urban areas where rental space is at a premium. These advantages explain why this strategy continues to gain ground with investors.

Students, young professionals, and those seeking shorter-term agreements, such as digital nomads, can all be ideal tenants for shared living properties. Enhancing your offering to accommodate the co-living experience can position your HMO in the premium market segment.

Expected rental yield from HMO? Typically, between 8% and 12%, according to ABC Finance.

TURNING BTL INTO APARTMENTS

Creating standalone flats from a single-use property will require funds, time and effort in the initial phases. You’ll need to consider building repurposing costs and extensive planning permission, plus you’d be betting on a market less stable than single-family homes.

There are positives to this setup, though. As with HMOs, you’ll receive rent from each tenant, spreading the risk across multiple occupants. You can also expect a higher rent per flat than per HMO room. However, you must weigh these benefits against the initial cost and the lack of rental income during the period the property is being converted.

Another potential benefit of converting a house into flats is the significant rewards when you come to sell. You’ll essentially have two or three separate properties to showcase to buyers.

Choosing between an HMO, a single let and a flat conversion should be based on carefully assessing your investment goals, risk tolerance, financial capacity, and time commitment. These rental models have the potential to be profitable, but they call for tailored strategies and involve distinct levels of engagement and expertise in property management.

Is Buy To Let Worth It?

The decision to invest in BTL properties is significant, and like with any other investment, you must assess both the advantages and challenges. Here’s a condensed review of the pros and cons of BTL:

Pros of BTL

- Steady Income Stream: One of the most appealing aspects of BTL is the potential to generate a consistent monthly income from tenants. If managed well, this can cover the mortgage payments and operational costs, with surplus income as profit.

- Capital Growth: Over time, property values generally increase. This capital appreciation can result in substantial gains when you sell the property.

- Leverage: BTL allows investors to power their investments using mortgage finance. This means you can own an asset for a fraction of its price.

- More Control: Unlike stock-market investments, you have direct control over your BTL property and can influence its value through improvements and effective management.

Cons of BTL

- Market Fluctuations: Property markets can go down as well as up. Economic downturns and changes in the housing market can affect your rental income and the property’s value.

- Responsibilities as a Landlord: Being a landlord entails far-reaching legal and maintenance responsibilities, from ensuring the property is safe and habitable to dealing with tenant issues. It can be time-consuming and sometimes stressful.

- Initial and Ongoing Costs: The initial expenses involve a high deposit, stamp duty, and possibly refurbishment. Ongoing costs include property maintenance, management fees, and mortgage repayments during void periods.

Avoiding Buy To Let Pitfalls

To highlight what thorough research, careful financial planning, and ongoing management can do to protect your BTL investment, here are ten common pitfalls in BTL and best practices to stay on track:

- Underestimating Refurbishment Costs: Failing to budget for renovations accurately can lead to financial shortfalls and impact the profitability of the investment. Always get multiple quotes for renovation work and include a contingency budget of at least 10-20% for unforeseen expenses.

- Overestimating Rental Income: Projecting rental income too optimistically can result in financial planning based on unrealistic returns, potentially leading to cash flow problems. Conduct thorough market research to understand the local rental market. Base your income projections on current rates for similar properties in the area.

- Vacancy Periods: Not accounting for possible void periods can disrupt cash flow. No tenant means no rental payments to cover mortgages and other property-related expenses. Set a buffer to cover mortgage payments and other costs during vacancy periods. Aim to maintain a reserve fund of three to six months of property expenses.

- High Maintenance Costs: Older properties or those in poorer condition can incur unexpected maintenance and repair costs, eroding profit margins. Schedule and conduct regular maintenance to prevent costly emergency repairs. Consider a property management company if you can’t handle maintenance personally.

- Changes in Market Conditions: Fluctuations in the real estate market can affect property values and rental rates, impacting the investment’s return. Stay informed about trends and economic factors impacting the local property market and your investment. This can help you anticipate changes in property values and rental rates.

- Problematic Tenants: Dealing with difficult tenants can lead to unpaid rent, property damage and legal costs, which affect your bottom line. To minimise this risk, implement a rigorous tenant screening process to include credit scores, references, and background checks.

- Interest Rate Increases: If you have a variable-rate mortgage, rising interest rates can increase your monthly payments, affecting your profitability. To protect against interest rate increases, consider the fixed-rate mortgage option; this guarantees stable mortgage costs for the period of the fix, although at a higher interest rate.

- Regulatory Changes: Changes in landlord-tenant laws, building codes, and housing regulations can introduce additional costs or limit your ability to increase rents. Keep up with all regulatory changes that affect property rentals. Consider legal consultation to remain compliant with evolving laws.

- Taxation Issues: Miscalculating or neglecting tax obligations can lead to unexpected bills and penalties. Consult with a tax advisor to understand all the implications and strategies for efficiently managing your tax obligations, including rental income and capital gains. Remember that regulationsare never static, so you must stay current on how taxation updates may impact your investments.

- Liquidity Risk: Property is not a liquid asset, and selling might be problematic if you need quick access to capital. Have a clear plan for liquidity to manage any sudden need for cash without the need to sell the property hastily and potentially at a loss.

Takeaways on BTL investment

There are a whole host of options available to rental property investors. BTL can create high yields and are an excellent long-term investment, but owners should weigh the pros and cons before making such a big decision. You should assess the legal and capital gains tax considerations, project complexities, potential rental income, and ongoing landlord tasks before deciding on the best rental model for your property.

Buy to Let (BTL) has long been popular for property investors seeking to build wealth through real estate. Yet, you must consider the state of the housing market and economy at the point of investing, as increased house prices and high interest rates could result in inflated mortgage costs that reduce your yield from a BTL property.

- BTL offers the dual benefits of generating regular rental income and potentially gaining from property value appreciation over time.

- BTL can be a relatively straightforward entry into the property market, especially for those new to real estate investing.

- It requires careful consideration of various factors such as location, property type, market conditions, and financial commitments.

- The success of a BTL investment largely depends on choosing the right property in the right area, securing favourable mortgage terms, and effectively managing the property and tenant relationships.

- Investors must stay informed of regulatory changes that could impact their investments, such as adjustments to tax laws or tenancy regulations.

Purchasing BTL properties with good potential for HMO conversions can create a future pipeline for development. Are you keen to turn possibility into reality? Let me help you transform your property investment into sustained development and growth. Contact us today.

Get in touch for a free discovery call with HMO Architects to discuss your property project. Whether you’re converting or buying, starting or looking to refine your investment strategy, let’s unlock the next step in your property venture.

Stay up to date and leverage first-hand insights from industry specialists. Join us in our next webinar where we dive into the dynamic world of property investment, and you gain practical knowledge on development, design, and innovative strategies to scale your property portfolio.

This content is for informational purposes only. It does not and is not intended to constitute legal, tax, investment, or financial advice. We recommend doing your own research or consulting a professional before making investment choices.

Ryan Windsor, Development Director and co-founder of HMO Architect, brings over 15 years of specialised experience in HMO development to the table. Having consulted on nearly 2,200 projects, Ryan is a highly seasoned HMO landlord with a vast and influential property network. He began his real estate journey at just 17, rapidly amassing a wealth of experience that sets him apart in the industry. Beyond his professional successes, Ryan is passionately dedicated to giving back, leading numerous charitable initiatives that make a meaningful impact on local communities.