Considering property investment but lack substantial capital or desire for hands-on management? If you are looking for a simpler route to participate in real estate markets —and get regular income without the usual financial outlay or management headaches— REITs may be your perfect starting block. Their high liquidity and regular income make them an ideal choice for many investors. Join us to explore REIT’s approach to property investment, how it works, and the opportunities, key sectors, and alternatives for your investment portfolio.

WHAT ARE REITS?

Real Estate Investment Trusts, known as REITs, give access to property investments without requiring ownership of any physical property. A REIT is a company or a group that uses funds to invest in a wide array of property assets, from commercial complexes to residential units, allowing individuals who invest in REIT shares to earn dividends without buying, managing, or financing properties themselves. In simple terms, think of REITs as a gateway to real estate investment without becoming a landlord.

REITs are traded on major stock exchanges —unless they are private placement REITs. In this guide, we’ll focus on the stock exchange-listed kind.

HOW DO REITs WORK?

REITs generate income from rental properties, lease agreements, or property sales. These companies must share most of their profits with investors through dividend payments. Overall, this is how REITs operate:

– The REIT collects funds from various investors, creating a substantial pool of capital.

– The capital raised is allocated to purchase a portfolio of real estate assets. This portfolio can include spaces in retail, residential, healthcare, student accommodation, industrial or a combination of such real estate assets.

– Properties within the REIT make money primarily through leasing space to tenants. The rent accumulated forms the primary source of revenue for the REIT.

– By law, REITs must distribute at least 90% of their taxable income to shareholders yearly. This dividend provides a steady income stream to investors.

– Investors also benefit from the appreciation in property value over time without the need for direct management or ownership responsibilities.

In the UK, to qualify as REIT and trade in the London Stock Exchange (LSE), these companies must meet the criteria set by the HMRC; these stipulate, for example, that a minimum of 75% of the group’s profits must come from their property rentals.

TYPES OF REITS

REITs are categorised into three types: equity, mortgage, and hybrid. Each type has distinct risk and return profiles.

| Type | Operation |

| Equity REITs | Own and operate income-generating properties; generate revenue mainly from rent. |

| Mortgage REITs (mREITs) | Provide financing for income-producing real estate by purchasing mortgages or mortgage-backed securities; earn income from interest. |

| Hybrid REITs | Combine both equity and mortgage strategies, investing in properties and mortgage loans. |

WHAT DO REIT MANAGERS AND BROKERS DO?

REIT MANAGERS (AND HOW DO THEY IMPACT YOUR INVESTMENT)

The REIT manager is a key player in the success and direction of this financial instrument. They are the professionals making the investment decisions, managing daily operations, and allocating assets to optimise the trust’s performance. Their functions include selecting the properties for acquisition and disposal (sale), overseeing property management companies and compliance matters, negotiating leases, and ensuring a balanced, profitable portfolio.

The performance of REIT managers directly impacts investor returns, making their role central to the trust’s success.

Tip: The REIT’s management information is publicly available for listed REITs, and you can access it through the company’s website —often under Investors Relations, in annual and quarterly reports, as well as financial news websites.

REIT BROKERS (AND WHY YOU MAY NEED ONE)

REIT brokers are not involved in managing REITs. Instead, they help investors buy and sell REIT shares on stock exchanges, offering research and analysis and processing the buy and sell orders for REIT shares. There are different types of REIT brokers, from traditional financial intermediaries to online algorithmic solutions. They simplify the investment process and provide the information you need to make informed decisions.

– Banks with investment services allowing REIT investments

– Traditional stockbrokers, which provide access to REITs along with other securities

– Specialised property investment platforms

– Online investment platforms where you can directly buy and sell REIT shares

– Robo-advisory services that include REITs in their portfolio

Tip: Different brokers offer different levels of guidance, transparency in fee structure, investment control, minimum investment requirements, and degree of automation.

HOW TO INVEST IN REITS IN 5 STEPS

Entering the REIT market is accessible for most investors, given their availability on major stock exchanges. Briefly, investing in REITs involves:

1. Setting clear investment goals and understanding the different types of REITs.

2. Research potential REITs to find those that match your risk tolerance and investment goals.

3. Deciding the strategy, e.g. to diversify across various types of REITs to mitigate risk.

4. Finally, purchasing shares through a brokerage account

5. Monitoring the performance and financial health of the REITs in your portfolio.

While you don’t necessarily need a specialised broker to access listed REITs, mastering these instruments demands frequent research, getting information from multiple sources and developing analytical skills in the real estate and stock markets. Investing in REITs carries financial risks, but with the proper research and a well-chosen broker, you can mitigate these risks and potentially earn significant returns.

REIT PERFORMANCE FACTORS

On the strategic side, the location and quality of the properties within a REIT portfolio can affect its performance —this is where the group’s financial structure and the expertise of its management team are critical. Investors often evaluate these factors along with historical performance data.

However, the performance of a REIT is heavily influenced by other economic factors, especially interest rates —often underperforming when rates go up. Factors such as market conditions, economic trends, and the overall health of the real estate market also play a role.

Understanding these elements can help predict potential returns and assess the risk associated with a particular REIT investment.

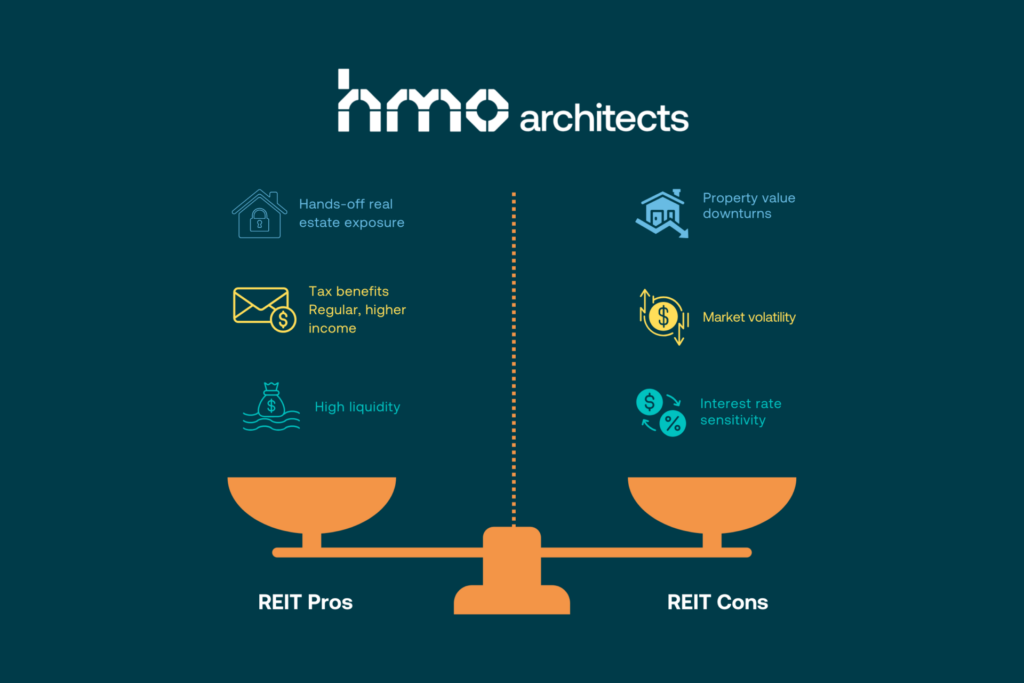

THE PROS AND CONS OF REITS

As mentioned, REITs provide exposure to real estate without the complications of direct property management. It’s more of a wide entry to real estate markets across postal codes, countries, and sectors and a hands-off approach that appeals to many investors. But let’s look beyond this obvious consideration.

ADVANTAGES

REITs traded on major exchanges allow investors to buy and sell shares relatively easily; this high liquidity means access to capital can be much faster than by selling a property. They also offer regular income through dividends, typically higher than many other types of investments.

REITs’ tax setup is particularly attractive. For instance, unlike traditional property companies, these investments can bypass corporation tax (because of that 90% income distribution rule), allowing investors to skip the double taxation, paying only on Property Income Distribution.

CHALLENGES

Conversely, REITs are susceptible to interest rate fluctuations, affecting yield. Generally, market volatility can impact share prices, and because they are tied to the real estate market, they can be affected by downturns in property value.

REITS VS DIRECT OWNERSHIP: OTHER PROPERTY INVESTMENT OPTIONS

The key difference between investing in REITs and owning property directly is the level of involvement and liquidity. REITs offer hands-off investment opportunities with regular dividends and are less capital-intensive upfront. On the other hand, direct ownership requires significant capital or financing, involvement with ongoing maintenance, managing tenants, and compliance with regulations. Focusing on the residential market, for example, leads you to different buy and lease routes, including:

– Buy-to-let to benefit from long-term property appreciation and regular rental income with a single tenancy.

– BRRRR , where you buy and refurbish properties to raise their value, refinance and rent them, and potentially repeat the cycle to grow your portfolio. This strategy demands know-how in property renovation and finance.

– A rent-to-rent agreement, which isn’t direct ownership, takes direct involvement in the management to lease a property and sublet it at a higher rate. This approach requires expertise in various areas, including market rates and tenant management.

– The profitable HMO route allows you to cater to specific tenant markets, including students, professionals, seniors, social, and the high-end of the shared-housing model, co-living. These rentals are known for their potential for higher returns (due to the room-by-room rental model). Still, they face enhanced controls and restrictions, including building and safety regulations and Article 4 direction.

– Serviced accommodation, which combines elements of both residential real estate and hospitality services. These property investments offer hotel-like amenities for short-term and extended stays, increasing management considerations in exchange for potential higher rents.

Direct investments where you own the property can help you diversify your portfolio. Whether you focus on residential, retail, commercial, or any other property sector, ownership requires long-term dedication and specific knowledge of each market. In contrast, REITs often select and operate across top real estate sectors, opening a hands-off route into diversification for investors.

Yet, direct ownership’s greatest advantage for investors who wish to retain control over their property and the direction of their investment is the potential for higher returns through rent collection and property appreciation. The starting point and outcome of your investment depend mainly on your strategy; let’s discuss it so you can achieve your financial goals.

TOP PROPERTY SECTORS FOR REITS

At the time of writing, the 48 REITs listed on the London Stock Exchange consolidated a market capitalisation of over $57bn. Their portfolio spans the industrial, office, residential, retail, speciality, hotel and lodging sectors.

“Historically, the leading sectors offering the largest scale investment opportunity included retail centres, apartment buildings, office buildings, and industrial warehouses” —FTSE Russell research. Yet, the property market continues to evolve, and REITs are moving their focus to new sectors on the rise, including health care, storage, and data centres, along with other real estate supporting the tech economy.1

1. Residential REITs include apartment buildings, manufactured housing and single-family home sector. These are particularly attractive in markets with low home affordability, population, and job growth.

2. Industrial and Logistics REITs invest in warehouses and distribution centres, which are increasingly crucial in REIT portfolios thanks to the rise of e-commerce. These assets can secure a steady income through long-term leases to companies requiring storage and shipping capabilities.

3. Healthcare REITs focus on buying and developing hospitals, medical centres, nursing facilities, and retirement homes.

4. Retail REITs are the sector for shopping centres. Although challenged by the rise of e-commerce, well-positioned retail REITs can still be profitable, especially those with mixed-use developments and locations that enhance foot traffic, such as supermarkets and home improvement stores.

5. Office REITs, which focus on workspace assets leased to banks, law firms, and government agencies, among others. These office buildings are an asset for REITs due to the long-term leases. However, some reports show how earnings from this industry have decreased. Trends such as hybrid work are increasing demand for more flexible office spaces and green credentials.

6. Diversified REITs invest across multiple property sectors, balancing their exposure. For example, Custodian REIT (CREI), with 155 assets (Annual Report 2024), diversifies across industrial, retail and other sectors, locations, tenant base and lease terms.

Tip: Dive into REIT quarterly and annual reports; soon, you’ll get a sense of the trends, such as rising and best-performing sectors, forecasts and risks.

TOP 10 REITS FOR HIGH DIVIDEND YIELDS

Let’s explore the performance and potential returns in the UK REIT market. These trusts range widely in market capitalisation (i.e., the total value of all outstanding shares of the REIT’s stock) and specialise in everything from traditional sectors like retail and office spaces to emerging areas such as logistics and social housing.

The following table showcases the top 10 REITs (as of 07/11/2024) based on dividend yield, a snapshot of their market cap and sector focus. You can monitor the market performance with updated information in the Data portal for UK REITs.

| Name | Market Cap (£m) | Dividend Yield (%) | Sector |

| NewRiver | 305.38 | 16.25 | Retail |

| AEW UK | 129.59 | 9.78 | Commercial |

| Regional | 330.97 | 8.34 | Office |

| Real Estate Investors | 60.09 | 7.46 | Office, Retail |

| Highcroft Investment | 38.04 | 6.53 | Commercial |

| Drum Income Plus | 18.15 | 6.32 | Commercial |

| Impact Healthcare | 360.42 | 5.57 | Healthcare |

| Custodian | 371.75 | 5.55 | Diversified |

| Supermarket Income | 709.35 | 5.49 | Retail |

| Standard Life Investments | 248.51 | 5.37 | Industrial, Office |

DECIDE IF INVESTING IN REITS IS RIGHT FOR YOU

If you’re pursuing profit in the property market, seeking to diversify your portfolio, and either want to preserve liquidity or avoid the many layers of property management, investing in REITs may be the right fit.

However, like most investments, REITs come with their risks. Their performance is linked to property and stock market dynamics and macroeconomic factors, particularly interest rates. Typically, these instruments require at least an intermediate understanding of investing —hence the appeal of dealing with a trusted broker.

Consider consulting with a financial advisor to ensure your investment choices align optimally with your financial objectives. Get in touch to discuss your property investment strategy —whether its feasibility assessment, advice on property selection and acquisition, project management to oversee your entire conversion process, or development from small scale to grand designs, our expertise and success rate precedes us.

Reference

1 https://www.lseg.com/content/dam/ftse-russell/en_us/documents/research/how-reits-deliver-access-new-economy.pdf

Disclaimer

The information provided on this blog is for general informational purposes only and should not be considered legal, tax, financial or investment advice. Please note that laws, regulations, and market conditions change. Verifying the information’s accuracy and relevance before making any decisions is crucial.

Ryan Windsor, Development Director and co-founder of HMO Architect, brings over 15 years of specialised experience in HMO development to the table. Having consulted on nearly 2,200 projects, Ryan is a highly seasoned HMO landlord with a vast and influential property network. He began his real estate journey at just 17, rapidly amassing a wealth of experience that sets him apart in the industry. Beyond his professional successes, Ryan is passionately dedicated to giving back, leading numerous charitable initiatives that make a meaningful impact on local communities.