What if the property that’s supposed to build your wealth could end up costing you thousands? Operating an unlicensed HMO could do just that. For many investors, the appeal of HMOs is clear: maximised rental income and diversified tenant pools. But, without the proper licence, that same HMO could become a financial trap. In this guide, we’ll go through the risks of running an unlicensed HMO and, more importantly, the steps you can take to avoid that mistake.

WHAT IS AN UNLICENSED HMO?

A House in Multiple Occupation (HMO) is a property rented out to three or more tenants who aren’t part of the same household but share communal spaces like kitchens, bathrooms, or living rooms. When we look at investment strategies in the rental market, HMOs stand out for their potential to generate enhanced returns. The advantage of letting rooms individually is that it can render higher rental yields than a single-family rental property.

However, HMOs face heightened scrutiny. By their nature, these properties can present distinctive challenges, from potential overcrowding to increased fire risks. That’s why licensing becomes a vital tool for councils, verifying that all safety measures are in place and that landlords are maintaining proper standards. One critical point to stress: regardless of how well-maintained your HMO might be, running it without the necessary licence—when one is required—exposes you to significant penalties. So, keep in mind that the property’s condition doesn’t relieve the legal requirement for a licence.

LICENSING EXCEPTIONS: NON-HMO PROPERTIES

Not all shared properties require an HMO licence. If you rent to fewer than five tenants, your property may fall outside the licensing scope. But one key aspect about licences for HMOs is that some councils have stricter guidelines, making engaging with local authorities essential.

WHEN DO YOU NEED A LICENCE FOR YOUR HMO

The baseline is simple: HMOs with five or more tenants or multiple storeys typically require a licence. However, and this is crucial to understand, many local authorities have additional requirements. Councils could enforce licencing for smaller HMOs as part of a broader housing strategy.

Failing to comply with these regulations can impact the entire property portfolio, and it’s best to treat compliance as a fundamental part of your investment strategy rather than a corrective action.

WHAT ARE THE RISKS OF AN UNLICENSED HMO

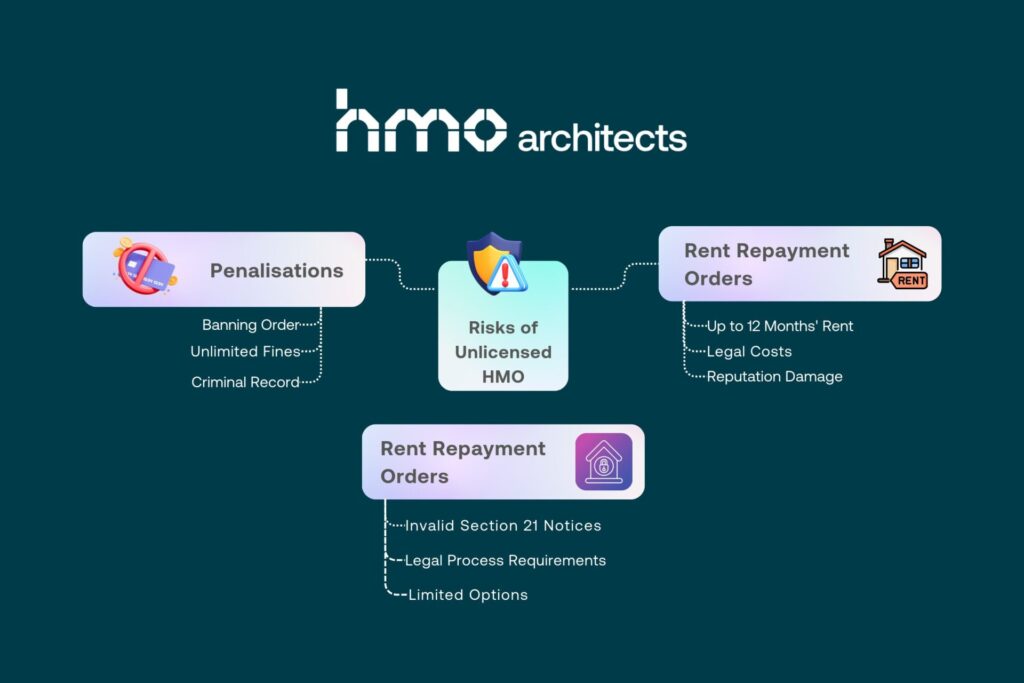

Landlords running an illegal HMO are taking significant risks with their investments. The penalties for unlicensed HMOs can lead to substantial fines, bans from renting out properties (banning order), and even prosecutions, depending on the extent of the breach. Councils are increasingly vigilant, and delaying or cutting corners can cost much more than the licence itself.

UNLICENSED HMO FINES: HOW MUCH COULD YOU BE FINED?

Operating an unlicensed HMO is an offence, and penalties can do more than disrupt cash flow and erase profits. Fines can range from a few thousand to tens of thousands, but contrary to the idea that there is a maximum penalty for non-compliance, landlords can face unlimited fines. It only takes a quick look to find a record of local authorities imposing hefty six-figure penalties— like a £480,000 fine issued by Kensington and Chelsea Council on a landlord and property managers for operating an illegal HMO.

Penalties can vary widely based on the severity of the offence and local council policies, and a conviction for illegal HMOs can also lead to a criminal record—adding to the long-term damage to reputation and the financial loss.

RENT REPAYMENT ORDERS: RECLAIMING RENT FROM UNLICENSED HMOS

A Rent Repayment Order (RRO) is a compensation mechanism that allows tenants and even local authorities to reclaim up to 12 months’ rent from landlords who have breached housing laws, including running an unlicensed HMO.

The financial implications extend beyond just repaying rent. If you receive an RRO, you’re also facing legal costs, time away from managing your properties, and potential damage to your reputation as a landlord. These factors can seriously affect your investment’s performance over the long term.

IMPACT ON EVICTIONS: COMPLICATIONS FOR UNLICENSED HMOS

An HMO license fulfils legal obligations and provides essential protections for landlords. Besides compliance with safety regulations and property management, having a necessary licence gives landlords access to enhanced insurance options, mitigating the risks associated, for example, with tenant disputes and property damage.

One aspect of unlicensed HMOs that surprises property owners is the impact on eviction proceedings. For instance, courts can be more reluctant to grant possession orders for unlicensed properties. This effectively ties your hands when dealing with problematic tenants, whether they’re violating the tenancy agreement or not paying rent. This situation is more than the immediate headache of difficult tenants; it can create a domino effect, disrupting your property management and causing significant financial stress.

1. Invalid Section 21 Notices: Landlords cannot serve a valid Section 21 notice (a “no-fault” eviction notice) if the property is an unlicensed HMO and has no temporary exemption. This means that even if you attempt to evict tenants using this notice, it will be deemed invalid, and tenants have the right to remain in your property.

2. Legal Process Requirement: While the standard procedure involves serving a Section 8 notice when you have grounds for eviction, the reality is far more complicated when your property isn’t compliant. Landlords have been caught off guard by this —they assume they can follow the usual eviction steps, only to find that not having the relevant licence creates a significant legal obstacle. It’s a situation that can leave you with limited options, even when dealing with problematic tenants.

Failing to comply with HMO regulations puts your portfolio at risk. Staying compliant is a critical part of protecting your investment and reputation.

HOW TO AVOID AN HMO LICENCE

When clients ask me about operating without an HMO licence, my answer is clear—the only legal way is to ensure your property doesn’t meet the criteria that would require licensing in your specific council.

So, let’s focus on how to avoid a penalty for unlicensed HMOs and the steps to ensure compliance. The first step is to determine if your property requires an HMO licence. This depends on the number of tenants and the property’s layout. Once confirmed, you must submit your application before renting out the property—the cost and criteria depend on the council’s regulations and the complexity of your HMO.

Having guided numerous investors through HMO management, I can’t stress enough the importance of staying current with local authority guidelines. I usually recommend using a compliance checklist and calendar—it doesn’t have to be fancy, but it should help you manage renewal deadlines and regulatory changes. The key is to be proactive even if it’s only one property or the first of many in your portfolio.

NO HMO LICENCE? IMMEDIATE ACTIONS TO TAKE

If you’ve just realised you’re running an unlicensed property, don’t panic —but act quickly. The sooner you start the application process with your local authority, the better your position will be. Here’s what you’ll need to focus on to remedy the situation:

1. Rectify any breaches of health and safety standards immediately.

2. Submit your licence application.

3. Provide all necessary documentation, including certificates for gas safety, fire alarm tests, emergency lighting tests, energy performance (EPC) and electrical reports, and proof that the property meets living condition standards—keep in mind that some councils require annual updates for these certificates.

4. Once you’ve submitted your application, prepare for inspections. Expect the council to schedule an inspection —they’ll want to ensure your property meets all HMO standards—this is an opportunity to demonstrate your commitment to compliance.

There are two additional steps that can make a real difference:

First, consider bringing in a property law specialist. Their insights can be a great help in navigating these situations. They can offer tailored advice based on your specific circumstances and local regulations.

Second, and this is something I always emphasise to landlords: keep your tenants in the loop. Be upfront about the licensing situation and your plans to resolve it. This transparency goes a long way in maintaining good relationships with your residents.

COMMON ERRORS WHEN APPLYING FOR AN HMO LICENCE

One of the most recurring mistakes among HMO investors is underestimating the time needed to obtain a licence. The processing period varies significantly depending on the local council and the conditions of each application. Some councils aim for a quick turnaround of about 8 to 12 weeks (e.g., Manchester and Croydon), while others could take up to 20 weeks. Once again, the best thing to do is to start the application well before your tenants move in to avoid complications.

Two other issues that frequently trip up HMO licence applications are paperwork errors, such as submitting incomplete or incorrect documentation, and neglecting safety requirements, such as fire regulations or gas inspections. These oversights can get your application rejected and cost you valuable time and money.

3 KNOCK-ON REWARDS OF LICENCED HMOs

IMPROVED FINANCIAL AND LEGAL SECURITY

Compliance with HMO regulations offers long-term financial security and legal peace of mind. Staying licenced reduces the risk of rent repayment orders, costly legal battles, and eviction issues. Protecting your portfolio from these risks can help towards stable, predictable returns and fewer management headaches.

IMPROVED MANAGEMENT

A licenced HMO signals tenants that your property is well-managed and meets safety standards. This attracts higher-quality tenants, reducing vacancy rates and turnover. Happy tenants are also more likely to follow the house rules and look after your property, contributing to lower maintenance costs and smoother operations.

IMPROVED PROPERTY VALUE

While an unlicensed HMO can be a liability, a compliant HMO is an asset. It enhances the property’s market value, making it more attractive to potential buyers and investors. A compliant property adds a layer of long-term appreciation to your portfolio beyond the immediate rental income.

ACT NOW TO AVOID THE RISKS OF UNLICENSED HMOs

Ignoring licence requirements for your HMO can have devastating consequences, from heavy fines to losing months of rental income. Compliance is more than a legal formality; it’s a mechanism that serves everyone: government, tenants and landlords; ultimately, it is about protecting your investment.

If you’re concerned about your property’s compliance, our Urgent Compliance Consultation service offers expert guidance to help you get back on track quickly. Don’t wait until it’s too late—get your HMO licenced and secure your investment for the future. Book your consultation today and avoid the risks that could cost you far more than a simple licence fee.

Whether buying an operating HMO or converting a property into an HMO, we can advise you on the process before you complete any work or apply for a licence. Reach out for a free discovery call.

Please note that laws, regulations, and market conditions change. Verifying the information’s accuracy and relevance before making any decisions is crucial.

Giovanni is a highly accomplished architect hailing from Siena, Italy. With an impressive career spanning multiple countries, he has gained extensive experience as a Lead Architect at Foster + Partners, where he worked on a number of iconic Apple stores, including the prestigious Champs-Élysées flagship Apple store in Paris. As the co-founder and principal architect of WindsorPatania Architects, Giovanni has leveraged his extensive experience to spearhead a range of innovative projects.