Investing comes with a variety of options, but two of the most common strategies are putting their money in the property market through HMO accommodation, other buy to let properties or investing in the stock market with shares and funds. All options have their own pros and cons and suit different investment strategies and risk profiles.

But with property prices and rents rising in many areas along with stock markets hovering near all-time highs, the choice between the two major asset classes is not always straightforward. If 2024 is the year you want to invest in HMO properties, convert a property into a profitable HMO or adapt existing properties to attract long-term and profitable tenants, this short guide will help you understand the key differences and benefits of any investment strategy.

Comparing HMOs, Buy To Lets and Stocks

In making the choice between buying into HMO properties, private residences or stocks as investment vehicles, it’s crucial to delve into their differences. Understanding these discrepancies sheds light on why one asset class often holds more appeal than the other and aids investors in making informed decisions.

Understanding the Nature of any Assets

Buy to let investments constitute tangible assets, allowing investors to interact physically with the property. In contrast, stocks represent fractional ownership in a company and are intangible. Additionally, property values heavily hinge on location factors, whereas stock values are contingent upon company performance and market dynamics.

If property is your go-to investment strategy, thorough research into optimal property investment locales in the UK is advisable prior to committing funds, as well as looking into what renters are looking for in a property such as closeness to amenities and energy-efficient homes.

Realising Levels of Liquidity

Property tends to be illiquid, often requiring several months to sell, while stocks offer nearly instantaneous liquidity. Similarly, transaction costs are generally lower for stocks compared to the legal fees and property taxes associated with property transactions. To minimise these expenses and facilitate smooth exits, consulting with experts and selecting properties in areas with consistent demand is advisable.

Acquiring and Managing the Assets

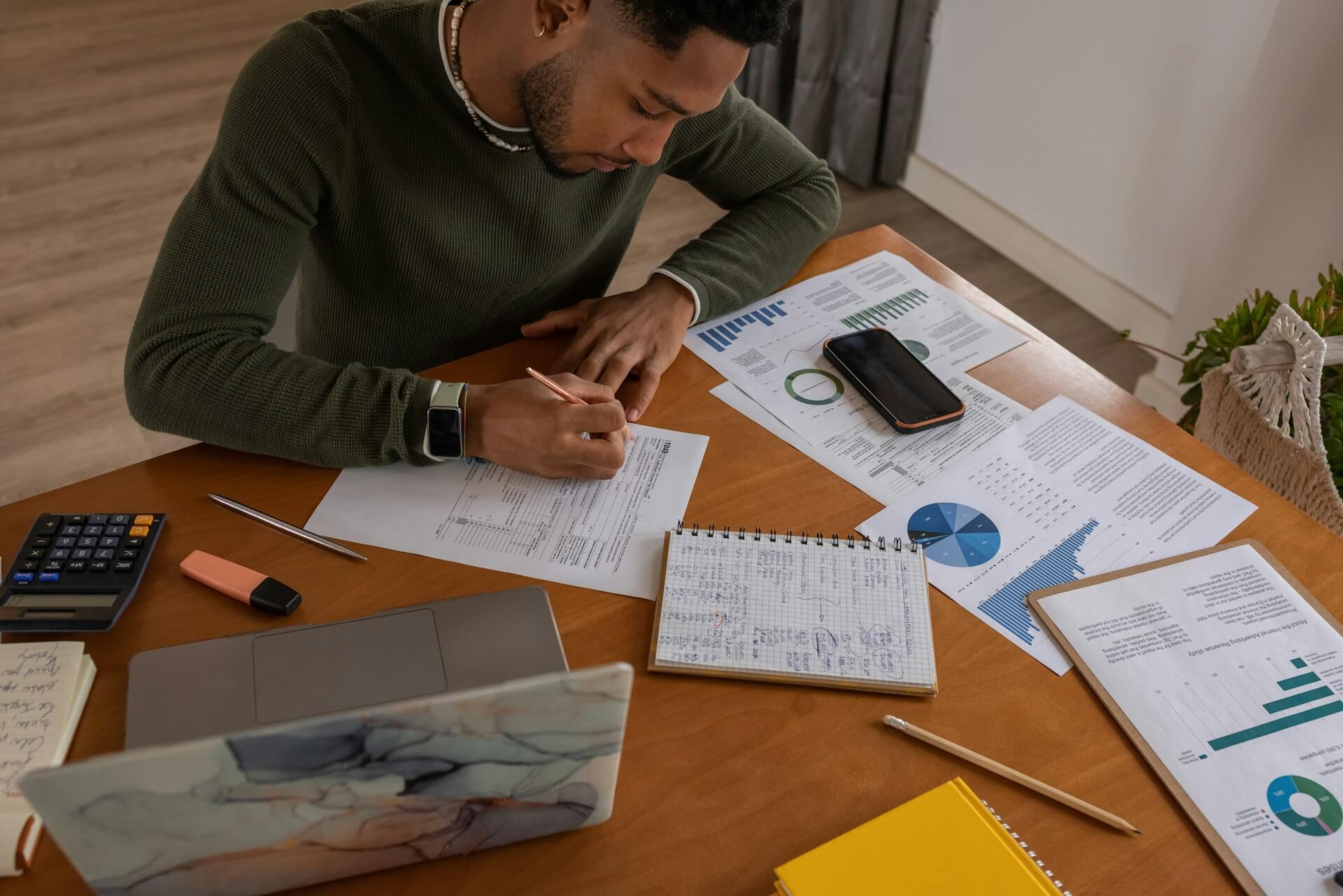

Property ownership usually necessitates active management, involving tasks such as property maintenance, HMO planning and tenant interactions, unless managed through a management firm. In contrast, one of the primary benefits of stock investments is that they can be managed passively with minimal involvement.

Moreover, leveraging funds for investment—commonly practiced with property due to lower lender risk—is more viable. Property investments can be calculated and afford greater control and stability, as the asset is less susceptible to volatility.

For those seeking steady, long-term income, property often emerges as the preferred choice; conversely, stocks might be favoured for high-growth potential and less involvement. Ultimately, diversifying across both asset classes typically offers the most effective strategy.

How to Decide: Pros and Cons of Investing in HMOs, Shares or Private Properties

When choosing between investing in the right HMO, other buy to let properties or stocks, asking yourself these key questions can help guide your decision:

Can you afford to buy an HMO or a private investment property?

The large deposit required for property investments can limit this option to those with substantial cash savings already. To invest in individual stocks also requires sufficient funds. But if your starting capital is limited, funds may provide better diversification. Small regular contributions to stocks are also possible, making it a more accessible option for some.

Do you want to invest small amounts regularly?

Contributing monthly to stocks and shares is possible even with modest sums, allowing for compound growth over time. HMOs and buy to lets require larger upfront investments, not just in terms of the deposit but also in maintenance and repairs, so it’s better if you have a lump sum.

Do you want regular income?

While dividends from stocks can provide income, it takes time to build up a portfolio substantial enough for considerable income. The rents from buy to let can provide steady cash flow each month once ready to let. It’s also important to consider how passive you want that income to be. Buy to let involves hands-on management like maintenance between tenants, whereas a stocks portfolio can be more passive once constructed, apart from occasional monitoring and rebalancing.

Do you have a high-risk appetite and tolerance?

Any investment comes with a level of uncertainty, so your personal risk tolerance and comfort level with volatility are important determinants. Stocks are more prone to price swings while property values tend to be more stable. If you are willing to take on higher risk for potentially higher rewards, stocks may be more appealing. For those wanting lower risk, property is likely the safer choice.

How will tax impact your strategy?

The tax treatment differs between the two assets, for example stamp duty on property purchases and capital gains tax on shares. Maximising after-tax returns should be considered as part of your investment strategy.

What is your current situation?

Factors like your age, income stability, debt levels and stage of life will impact your choice. Property investments tend to require more long-term planning and commitment, so may be better suited to younger investors. However, stocks offer greater flexibility if your situation might change in the future.

Reasons for the Preference for Property Over Stocks

There are several compelling reasons why experts tend to gravitate towards buy to lets and HMOs when opting between investment property and shares. Property yields ongoing income through rental payments, often surpassing stock market dividend yields in various UK regions. The stability of rental cash flow appeals to investors seeking regular income, with the flexibility to adjust rents over time to match inflation.

Property investments also present the potential for substantial capital appreciation alongside consistent rental income. Historically, property prices have exhibited an upward trajectory due to increased demand and limited supply, augmented by various tax incentives.

Lastly, property investment results in the ownership of a tangible asset, with intrinsic value stemming from the universal need for housing. During periods of economic uncertainty, property serves as a defensive investment, maintaining its worth. After all, as populations rise, more housing will be required which makes it a sound investment for landlords.

Seeking Expert Advice

When assessing whether to invest in shares, HMOs or other types of property, there is no universally correct answer – each investor’s personal circumstances and goals differ. Ultimately, determining the better option involves aligning the investment attributes with your own preferences, constraints and objectives. You can learn more about generating increased profits in our guide.

HMO Architect offers consulting services and advice on everything from HMO design appraisal, concept drawings and interior design to the highest quality to suit your needs, your ideas, and solve any problems. Need more certainty about your next move? You can book a free discovery call with the HMO Architect Team.

This article was written in collaboration with our content team member Annie Button.

Disclaimer: This content is for informational purposes only, it does not, and is not intended to, constitute legal, tax, investment, or financial advice. Investing in securities like stocks involves risk, including possible loss of principal. We recommend doing your own research or consulting a professional before making investment choices.

Ryan Windsor, Development Director and co-founder of HMO Architect, brings over 15 years of specialised experience in HMO development to the table. Having consulted on nearly 2,200 projects, Ryan is a highly seasoned HMO landlord with a vast and influential property network. He began his real estate journey at just 17, rapidly amassing a wealth of experience that sets him apart in the industry. Beyond his professional successes, Ryan is passionately dedicated to giving back, leading numerous charitable initiatives that make a meaningful impact on local communities.