Dreaming of building a property portfolio that paves the way to financial security?

You’re not alone—many see real estate as a path to long-term wealth and a steady stream of passive income. But let’s be real, it’s not always a smooth ride. From dealing with market swings to juggling property management, it can feel like walking a tightrope. So, how do you keep the balance? Let’s tackle that challenge and explore the key steps to not just build but grow a robust property portfolio.

WHAT IS A PROPERTY PORTFOLIO?

First things first—what exactly is a property portfolio? Simply put, it’s a collection of real estate assets owned by an individual or group. The properties in a portfolio can range from residential homes or buy-to-lets (BTL) to houses in multiple occupation (HMOs), commercial buildings, and serviced accommodation.

When building a property portfolio, you’re buying and owning actual real estate, unlike investing through financial instruments like Real Estate Investment Trusts (REITs). In this guide, we focus on direct property ownership. Like other investors, once you’re set to create a portfolio, you’ll need to decide which structure suits your strategy best, personal ownership, a Limited Company (LTD), or perhaps a pension scheme like a Self-Invested Personal Pension (SIPP) or a Small Self-Administered Scheme (SSAS). Each has its own tax benefits, liability considerations, and flexibility. An overview is always a good start, we’ll kick off from there:

Personal Ownership

Owning property in your name means you’re personally responsible for everything that comes with it. This includes managing the property and handling the financial and legal implications. Any profits from the property are treated as personal income, which could push you into a higher tax bracket, leading to higher income tax rates. While this approach might seem straightforward with fewer management hassles, it doesn’t offer the tax benefits or liability protections that come with owning property through a business entity.

Limited Company (LTD)

Choosing to own a property portfolio through a Limited Company (LTD) can be a smart financial move. With an LTD, rental income profits are subject to Corporation Tax, typically lower than personal income tax rates. This approach also offers the advantage of treating mortgage interest as a deductible expense, reducing the amount of tax owed by the company. Additionally, owning property through LTD helps keep personal and company assets separate, reducing personal risk if legal or financial troubles arise.

There are other benefits to consider. For instance, if your estate beneficiaries inherit your property portfolio, they might qualify for Business Relief, potentially lowering Inheritance Tax. This makes the LTD route particularly appealing for investors looking to structure their portfolios efficiently.

Of course, there are trade-offs. Owning property through an LTD requires more rigorous accounting and administration, and you may find mortgage options less favourable than in personal ownership.

Pension SIPP/SAP

Investing in property through a pension fund, like a Self-Invested Personal Pension (SIPP) or a Small Self-Administered Scheme (SAP), offers unique tax advantages. The key benefit is that any rental income or capital gains from property investments within the pension are generally exempt from income tax and capital gains tax. This tax-free growth can be a compelling reason to choose a SIPP or SAP over traditional ownership methods.

However, there are some limitations to consider. Property investments made through a SIPP/SAP are generally restricted to certain types of properties, with commercial real estate being the most common choice. Also, the funds in a SIPP/SAP are typically locked until retirement age, reducing the flexibility to access the investment capital earlier.

WHY BUILD A PROPERTY PORTFOLIO?

Building a property portfolio offers potential benefits over the short and long term. The primary purpose is to generate income —through renting these properties, with the variable bonus of capital appreciation —holding them as investments that can increase value over time.

While a buy-to-let (BTL) investment (purchasing a property specifically to rent it out) can be a lucrative option, going the conversion route can be a savvy strategy. Take for example HMOs, we can often increase the value of a property in two ways:

- Through conversion, by changing from a BTL or a residential home into an HMO.

- By extending and adding more rooms increasing the commercial value of the property —which can often be a few times higher than the brick-and-mortar value, thus offering new prospects to refinance and take money out to invest again.

This strategy, known as BRRR (Buy Refurb Refinance Rent), is popular among investors looking to build a property portfolio.

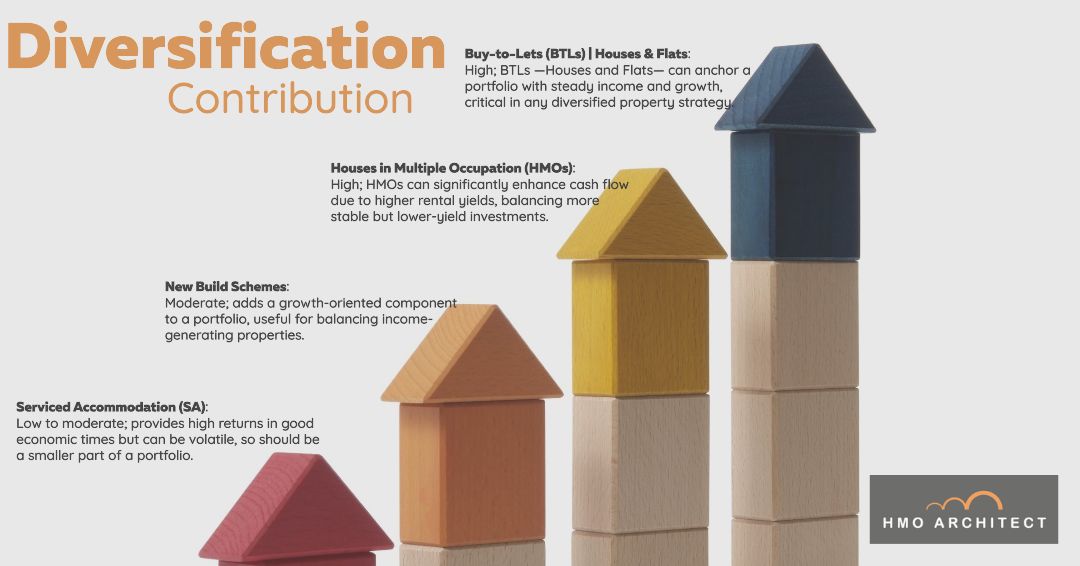

Diversification is an essential part of building an effective investment strategy, and property portfolios are no exception. For instance, including a mix of residential and even commercial properties in different locations can help minimise risk and maximise returns. It also provides flexibility and resilience if one market segment experiences a downturn.

Essentially, investors can build a property portfolio to diversify their assets, manage risks, and aim for long-term financial growth by strategically buying and managing real estate in different markets or sectors.

STEPS TO START A PROPERTY PORTFOLIO

1. DEFINE YOUR INVESTMENT GOALS

To begin, identify your financial situation and define your investment goals and budget. Whether you’re looking for quick profits through house flipping, long-term and steady income from rentals, or potential property value appreciation, understanding your financial capacity and investment horizon is essential.

You want to be as detailed and accurate as possible, setting clear and reasonable expectations. For example, you could build a clearer roadmap for building your portfolio by applying the SMART approach to your investment goals, and focus on creating objectives that are Specific, Measurable, Achievable, Relevant, and Time-bound. This can look like this:

- If your goal is to build a portfolio of rental properties for a steady income, you could set a specific target for the number of properties to acquire within a certain period.

- Ensure that your goals are measurable by defining key metrics, such as annual rental income or the rate of property appreciation.

- Your goals should be achievable based on your current financial situation and resources, and relevant to your overall investment strategy.

- Lastly, establish a clear timeline to keep yourself accountable and track your progress.

2. ASSESS YOUR BUDGET AND FINANCING OPTIONS

Setting up a realistic budget is a cornerstone of property investment. It involves assessing your financial resources and exploring financing options such as mortgages, property investment loans, or leveraging existing assets. Proper financial planning ensures you can sustain your investment until it generates returns.

- How much capital do you need to start a property portfolio? The money required varies depending on several factors, including property type, location, and financing options. Generally, you’ll need a deposit, closing costs (Broker and agent fees, Valuation fees, Surveyor costs, Stamp Duty Land Tax or SDLT, etc.), and funds for maintenance and emergencies.

- Financing Your Property Portfolio: Funding is a significant part of starting a property portfolio. You can choose from various options, from traditional financing for homes, flats and mortgages designed for HMOs or SA, to bridging financing, private loans, or partnerships with other investors. Consider your financial situation and long-term goals to select the best financing option. Don’t forget to shop around for the best mortgage rates and terms.

3. LOCATION: CONDUCT MARKET RESEARCH

Thorough market research and choosing the right location are critical steps to building a successful property portfolio.

You want to assess what type of properties you’re interested in, and it’s time to research the market to identify profitable locations and stay informed of property trends. Location is critical in real estate, so analyse areas with growth potential, good infrastructure, and a stable economy —think location, location, location when estimating the potential value of a property based on its locality. Keep an eye on the local and national market, including property values, rental yields, market trends, and broader infrastructure investments —e.g. High Speed 2 (HS2) or a new University— to ensure you’re making informed decisions.

4. CHOOSE YOUR INVESTMENT STRATEGY

In the UK, the property rental market offers a variety of options catering to different segments of the market, each yielding different returns and posing unique challenges. We explored five property types to consider when building a property portfolio.

Houses in Multiple Occupation (HMO)

Houses in multiple occupation, or HMOs, are properties rented out at least to three tenants who are not from one household (i.e., they are not a family) but share facilities like the bathroom and kitchen. These are popular in university towns and cities with high numbers of young professionals. Due to multiple income streams from the same property, HMOs can offer higher rental yields compared to single-family lets. However, they require more intensive management, adherence to stricter regulations, and potentially higher turnover rates.

Flats

Flats are a popular choice for many investors as they offer a good balance of yield and capital appreciation. Typically located in urban areas, these investments also tend to be cheaper to buy and rent than houses. Paired with the high demand for city housing, it translates into keeping void periods to a minimum. The success of these investments, of course, depends on factors like location, desirability of the property and market conditions.

Houses

Family homes are typically standalone houses or bungalows in suburban areas. Like flats, these houses usually involve renting the whole property to one tenant, who can be a family or even a single individual. The main advantage of single-family rentals (SFR) is the relative simplicity in management compared to properties with multiple tenants, as is the case with HMOs and SA. The leases for houses often have a longer duration, providing more stability in rental income. However, the downside is that if the property is unoccupied, it means losing 100% of the potential income until a new tenant moves in.

Serviced Accommodation

Serviced accommodation (SA) is a type of furnished, short-term rental property that provides guests with amenities typically associated with hotels, combined with the comfort and privacy of a home. For investors, SA typically offers promising benefits but requires important considerations. With their short-term rental model, these properties can generate higher returns than long-term rentals due to premium pricing and broader market appeal to business and leisure travellers. However, they require vigilant maintenance and management, with frequent turnover increasing operational complexity and costs.

Similarly to HMOs, SA is subject to regulatory compliance, and market sensitivity adds further challenges, meaning careful planning and oversight. The model can be a lucrative addition to a property portfolio, provided investors are prepared for the demands and risks associated with this investment strategy.

Commercial properties

While outside the residential property bracket, commercial spaces warrant an overview. Commercial real estate encompasses a wide range of properties, such as office spaces, retail units, warehouses, and factories, and requires distinct considerations compared to residential investments. They are typically leased to businesses rather than individuals and can offer long-term, stable leases and often yield higher returns. Since commercial leases are not subject to the Assured Shorthold Tenancy (AST) rules, landlords have more flexibility and greater control over property management. Additionally, in commercial leases, the responsibility for renovations and maintenance typically lies with the tenant, rather than the landlord.

However, commercial investments come with higher upfront costs and can be more sensitive to economic conditions. Another aspect to consider is that when a commercial property becomes vacant, finding a new tenant can take longer.

Are you looking for an alternative to test the waters without committing to direct ownership? Then, the rent-to-rent (R2R) model could be a good fit for your next investment. While still a venture with risks, renting a property to then sublet it can be an effective way to diversify your property portfolio.

5. FIND AND BUY YOUR FIRST PROPERTY

Finding and buying your first property requires careful planning and strategic action. Here are some essential tips to help you navigate this process, ensuring you find a fitting property deal and make informed decisions.

Finding Good Property Deals

- Research the Market (yes, yet again): Familiarise yourself with the property market in your target area. Understand typical prices, rental yields, and the demand for rental properties. Use online real estate platforms and property portals to compare properties and track price trends.

- Look for Below-Market Value Properties: Properties listed below market value (BMV) can often provide good deals. These might include foreclosed properties, auctioned homes, or properties that need renovation. A word of caution for aspiring investors: assessing any additional costs involved in making the property market ready is essential.

- Explore Off-Market and Direct to Vendor (DTV): Sometimes, the best deal isn’t on the open market. Consider networking with residents, joining real estate investment groups, and connecting with estate agents, which can help you find opportunities not advertised publicly.

Working with Real Estate Agents

- Choose the Right Agent: Partner with an agent with a strong track record in the type of property you are interested in and knowledgeable about the local area. A good agent can provide valuable insights and access to listings that might not be otherwise available.

- Communicate Your Goals Clearly: Your estate agent needs to understand your goals to know what your ideal property looks like, from asset type and size to location and budget. A Property Hunting Brief can save time and help the agent to focus on suitable properties that fit your goals and objectives.

- Leverage the Agent’s Expertise: Real estate agents can help you navigate the complexities of the buying process. Use their expertise to understand the legal implications, market conditions, and negotiation tactics.

Due Diligence and Property Inspection

- Professional Property Inspection: Before finalising any purchase, you can have the property professionally inspected to identify any structural issues, needed repairs, or potential problems. A pre-purchase consultation with professionals can help property investors prevent costly surprises down the road.

- Legal Due Diligence: Conduct a thorough legal review to ensure everything is in order. This includes verifying the property title, ensuring there are no liens or disputes, and confirming compliance with local building regulations. Your appointed Solicitor will assist with this process.

- Review Financials: If buying a rental property, review the existing financial records for rental income, occupancy rates, ongoing costs, and maintenance fees. This will give you a clear picture of the property’s profitability and potential expenses.

CHALLENGES AND RISKS IN PROPERTY PORTFOLIO BUILDING

Building a property portfolio can be lucrative, but it comes with its share of challenges and risks. Common hurdles in property investment involve securing reliable financing, identifying profitable properties, and navigating the ups and downs of real estate markets. These obstacles can make it challenging for new investors to gain traction.

Before you step into your next property investment, validate your priorities with a solid grasp of your goals and limitations. Consider how much time you can commit to managing a rental property, the long-term stability associated with each strategy and which professional services you can leverage. Remember, each property type receives for and against arguments. To illustrate this, you can consider:

Yield and Risk

Houses in Multiple Occupation (HMOs) have a reputation for offering higher yields because they generate income from multiple tenants. While HMOs can deliver robust returns, they intensify management and require strict regulatory compliance. The legal complexities of running HMOs involve meeting fire regulations, licensing processes, and navigating Article 4 restrictions in some areas.

Single-family rentals (also known as Buy-to-Let or BTL homes) are often seen as the foundation of a stable property portfolio. They offer a lower yield but provide steady, long-term income with relatively less management compared to HMOs or SA. These homes typically have longer tenancy durations, reducing the costs and hassle associated with frequent tenant turnover.

Flats are considered a lower-risk investment strategy compared to HMOs. They tend to have stable occupancy rates and lower tenant turnover, making them easier to manage, however, the yields are generally lower than HMOs. Flats are a solid choice for investors looking for moderate risk with consistent returns.

Serviced Accommodation (SA) offers the potential for the highest yields, especially in tourist-friendly locations, but managing them requires significant effort. SA typically involves short-term rentals, meaning you need a dedicated team to handle bookings, cleaning, maintenance, and guest relations. While the returns can be attractive, scaling up means the level of management and operational complexity is significantly higher compared to traditional rentals.

Management Intensity

HMOs and SA generally require more active management and specialised expertise due to their complexity and the various regulations involved. This includes managing multiple tenants in shared accommodation, ensuring compliance with building codes, and adhering to fire safety regulations. In contrast, Single-family rentals, such as houses and flats, are typically less time-consuming, making them a suitable choice for new or less hands-on investors.

On the brighter side, technology is becoming increasingly becoming a valuable asset for property investors and landlords. Property management software can help you streamline operations, making it easier to communicate with tenants, handle maintenance, and track finances.

Market Sensitivity

While commercial properties are generally more affected by economic changes —as businesses may downsize or close, impacting commercial rental demand, Serviced Accommodations can be sensitive to tourism trends and economic downturns, as they often cater to short-term guests. Local market conditions, tourism patterns, and broader economic shifts can impact demand for serviced accommodations.

On the other hand, residential properties, including HMOs and single-family rentals, usually expect more consistent demand due to the ongoing need for housing. Nonetheless, local market conditions and housing policies still affect market performance, and it’s essential to stay informed about regulations, trends, and industry cycles to anticipate changes in market performance.

Risk Management

Property portfolios face various risks, including unexpected property damage, costly maintenance and repairs, void periods when properties sit empty, and market downturns that can affect profitability and growth.

A key strategy to mitigate these risks is diversification, i.e., spreading your investments across different property types, locations, and tenant profiles. This approach reduces the risk of a single adverse event impacting the entire portfolio. To further manage risks, consider including an emergency fund for unforeseen expenses in your plan, and insurance for additional protection, such as HMO insurance for landlords.

Diversification, combined with these other risk management practices, helps ensure greater stability and resilience in your property portfolio.

GROWING YOUR PROPERTY PORTFOLIO

Reinvesting and expanding are vital strategies for growing your property portfolio. They provide pathways to scale and increase returns. You can leverage these funds to purchase additional assets by reinvesting profits from existing properties.

One common strategy for rapid expansion is to buy an existing portfolio from another investor. This method involves acquiring multiple properties at once, instantly boosting the buyer’s portfolio. While it can be a cost-effective way to expand —as buying in bulk often leads to lower per-unit costs, this course requires significant capital, so it’s essential to have a robust financing plan in place.

When reinvesting and expanding, it’s important to balance risk and reward again. Rapid growth can lead to increased risk, especially if you overextend financially or fail to conduct proper due diligence on your acquired properties.

So, how can you reduce the impact of market downturns and minimise exposure to any single risk factor? We circle back to the essentials: having a solid understanding of market conditions, property value, and potential returns on investment is non-negotiable. And we can’t forget the role diversification plays in balancing risk and reward. By investing in different types of properties and locations, you can create a more stable and resilient portfolio, especially as you expand.

What if you don’t have the lumpsum to secure a property? There are alternatives to participate in the sector beyond buying real estate. Investing via financial products such as stocks or funds following real estate assets is an effective path to benefit from the property market without direct ownership. You’ll need to decide which suits your investment strategy best, whether brick and mortar, the stock market, or a combination to diversify your portfolio.

Selling Properties in Your Portfolio

Selling properties within your portfolio is a strategic decision, but knowing when and why to sell is crucial for maximising profits and ensuring a healthy property portfolio. Typically, selling when property values are peaking allows you to capitalise on market demand and achieve a higher sale price.

Why sell a property? The reasons vary, but the decision to sell can be part of a broader investment plan or even as a corrective measure.

- When a property has appreciated significantly

- To free up capital for reinvestment and diversification

- To distribute the financial resources to maximise profits (capital allocation)

- Reduce risk in a portfolio

- A change of strategy or financial goals

- Higher property maintenance costs

- Offload underperforming assets

- A declining market

PROPERTY PORTFOLIO EXAMPLE

Could you start building your property portfolio with a small budget? Starting with low funds is entirely possible, but the scale of “small” can vary depending on your goals, location, and investment strategy.

A key factor to consider is the initial deposit required for property purchases, which is typically around 20% of the property’s value. This means you can start with a smaller budget by targeting more affordable properties or by leveraging financing through a mortgage.

One approach to begin with a limited budget is to invest in areas with lower property prices. This could involve purchasing smaller properties like studio flats or one-bedroom apartments, which require a smaller deposit. By focusing on such properties, you can reduce your upfront costs and still generate rental income to grow your portfolio over time.

Joint ventures with other investors are another strategy, which allows you to start with a small budget by pooling resources and invest in more substantial properties or units.

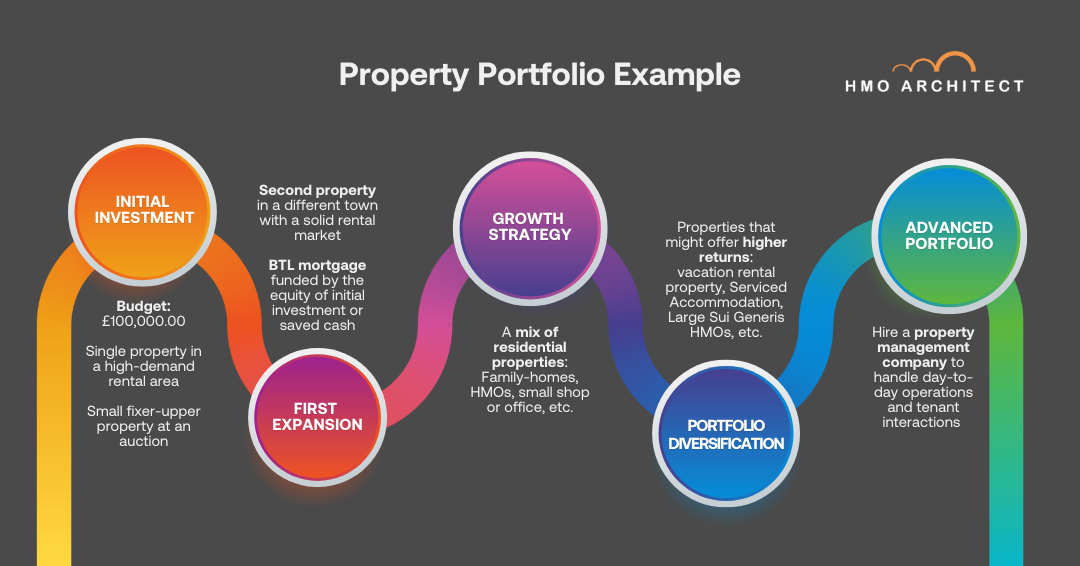

The reality is that there’s no single formula for a “best” portfolio to achieve property investment goals. Let’s consider a fictional scenario to illustrate how someone might build a diversified property portfolio over time, starting with a sensitive initial investment:

Initial Investment

- Budget: £100,000

- Strategy: Beginning with a single property investment focusing on a high-demand rental area.

- Property Type: Purchase a small fixer-upper property at an auction, using the budget to cover the deposit and partial renovations.

First Expansion

As the first investment generates rental income and appreciates, the investor uses the returns and any accumulated savings to invest in a second property.

- Property Type: Purchase a second property in a different town with a solid rental market, providing geographical and tenant diversification.

- Financing: Utilising a BTL mortgage with a deposit funded by the equity grown in the initial investment or saved cash.

Growth Strategy

As an ongoing strategy, the investor reinvests profits into additional properties and refinancing options to free up investment capital.

- Property Types: A mix of residential properties, from Family-homes to HMOs, or exploring the introduction of a commercial unit like a small shop or office, which can offer longer lease terms and potentially higher yields.

Portfolio Diversification

With a stable base of residential properties, the investor focuses on diversification into properties with different risk and return profiles.

- Property Types: It’s time to consider properties that might offer higher returns —for example during peak seasons— but come with higher risks and management costs. A vacation rental property in a popular tourist destination, Serviced Accommodation, and Large Sui Generis HMOs can prove lucrative options.

Advanced Portfolio

With a solid foundation, the portfolio might now include several residential properties, a commercial property, and special-use real estate like vacation rentals.

- Management: At this stage, hiring a property management company to handle day-to-day operations and tenant interactions could be beneficial, allowing the investor to focus on strategic growth and further diversification.

Example Properties in Portfolio

- Home: A family rental property in a residential suburb with good schools.

- Commercial Retail Unit: A small shop leased to a reliable tenant on a five-year lease.

- HMO: Located in the city centre, targeting young professionals

- Serviced Accommodation: A seaside cottage that is popular during the summer months.

Portfolio Goals and Adjustments

Our investor regularly assesses the portfolio to ensure it meets yield expectations and adjusts the strategy as market conditions change.

- Exit Strategies: Plan to sell specific properties eventually to capitalise on market highs or reinvest in more lucrative opportunities.

This property portfolio example shows how an investor could start small and gradually build a diversified investment portfolio. The key is a careful selection of properties, strategic reinvestment of returns, and timely adjustments.

TAKEAWAYS TO BUILD A SUCCESSFUL PROPERTY PORTFOLIO

- Understand key property types to decide which fits best with your investment strategy, risk tolerance, and management capacity. Each type has its benefits and challenges; the choice largely depends on your goals and resources.

- Building a property portfolio starts with education and small steps. Focus on solid investment choices and gradual expansion.

- Every step towards due diligence and careful selection helps mitigate risks and enhances the potential for a successful investment.

- Always monitor economic factors that influence property values and the rental market.

- Incorporate diversification and an exit strategy as part of your investment plan and risk mitigation.

- Consider working with experienced property managers, advisors and industry specialists who can help you navigate challenges and ensure a successful journey.

HMO Architect provides a wide range of consulting services, from planning and building regulations to design services, project management, and a complete suite specialised in HMOs, Flats, Service Accommodation and Homes, including design appraisal, concept drawings and top-quality interior design. Get your next steps with confidence and schedule a free discovery call with our HMO Architect team. We’re here to help with your questions and make sure your project aligns with your vision, goals, and requirements.

Ryan Windsor, Development Director and co-founder of HMO Architect, brings over 15 years of specialised experience in HMO development to the table. Having consulted on nearly 2,200 projects, Ryan is a highly seasoned HMO landlord with a vast and influential property network. He began his real estate journey at just 17, rapidly amassing a wealth of experience that sets him apart in the industry. Beyond his professional successes, Ryan is passionately dedicated to giving back, leading numerous charitable initiatives that make a meaningful impact on local communities.