We all love a good comeback, and giving an old retail building a new purpose while creating affordable living spaces is an excellent example. But before jumping into conversion work, you must know what you’re getting into—especially investors new to the HMO sector. You’ll need to get on top of local housing demands and licenses and ensure your building meets safety standards. The good news? With a solid strategy, commercial to HMO-conversions can do more than pay off.

HMOS AND COMMERCIAL RENTAL MARKET IN BRIEF

The demand for Houses in Multiple Occupation (HMOs) has seen substantial growth in the UK, giving property investors a way to maximise rental income. Besides the housing deficit known to most, the market also indicates that demand for shared accommodation is likely to continue rising, particularly HMOs tailored to specific tenant profiles, from students to senior citizens—both growing populations.

Conversely, vacancy rates for commercial properties, particularly those under Class E (including retail, restaurants, offices, and other commercial uses), have been a topic of concern in recent years. As of 2024, the estimated national vacancy rate for commercial properties, including those under Class E, is around 14-15%. Factors such as economic uncertainty, the rising cost of doing business, the growth of e-commerce and the shift towards remote and hybrid working all contribute towards a reduced demand for commercial spaces. It’s worth adding that it’s not all doom and gloom; the commercial property sector is also showing signs of adaptation with some innovative strategies on the rise—a topic for another time.

However, demand isn’t the only reason why converting a property makes a solid business case for property owners. While the initial work needs careful planning and meeting stringent regulations, many investors find that transforming unused or underperforming rental spaces can lead to higher returns in the long run.

WHAT IS A COMMERCIAL TO HMO CONVERSION?

A conversion from commercial to HMO is the process of transforming a service or shopping property, such as an office block, a shop, a former restaurant or even a warehouse, into shared housing for three or more unrelated tenants. This conversion involves changing the property’s legal use class from its current commercial designation to a C4 Class (for smaller HMOs) or Sui Generis (for HMOs with seven or more occupants).

It’s no news that HMOs are appealing to renters due to affordability —although the community lifestyle has gained relevance among different tenant profiles. As for landlords, these investments are lucrative because of the multiple rental income streams from a single property, making every square metre count.

WHAT ARE THE BENEFITS OF CONVERTING A COMMERCIAL PROPERTY INTO AN HMO

Looking at the bigger picture, converting commercial buildings into residential spaces can make financial sense, especially in areas where traditional shops or offices are sitting empty. A well-planned conversion can increase your property’s worth, particularly in locations where housing need outstrips commercial demand. However, remember that success depends heavily on choosing the right property in the right area—i.e. not every commercial space will make a suitable HMO.

HIGHER RENTAL YIELD

HMOs generate higher yields than traditional buy-to-let properties, as each room is rented individually. This increased income potential makes them attractive for investors looking to maximise their return on investment.

LOWER VACANCY RISKS

In an HMO, even if one tenant moves out, other tenants are still contributing to rental income —thus diversifying your income sources from the same property. This creates more income stability than traditional rentals, where a single vacancy means losing 100% of the lease.

CAPITAL GROWTH OPPORTUNITIES

Conversions can boost property value, as residential spaces, particularly HMOs, often command higher market prices than commercial properties that are no longer viable for their original use.

DO YOU NEED PLANNING PERMISSION TO CONVERT COMMERCIAL SPACE INTO AN HMO

When converting a property into an HMO, the planning requirements depend on your starting point. If you’re turning a regular house (Class C3) into a small HMO (Class C4) with up to six bedrooms, you might not need planning permission thanks to permitted development rights. However, you’ll need planning permission when converting a commercial property (Class E) into any type of HMO —whether it’s a small HMO (Class C4) or a large HMO (Sui Generis) with seven or more bedrooms. This is because changing from commercial to residential use is considered a significant change that requires local authority approval.

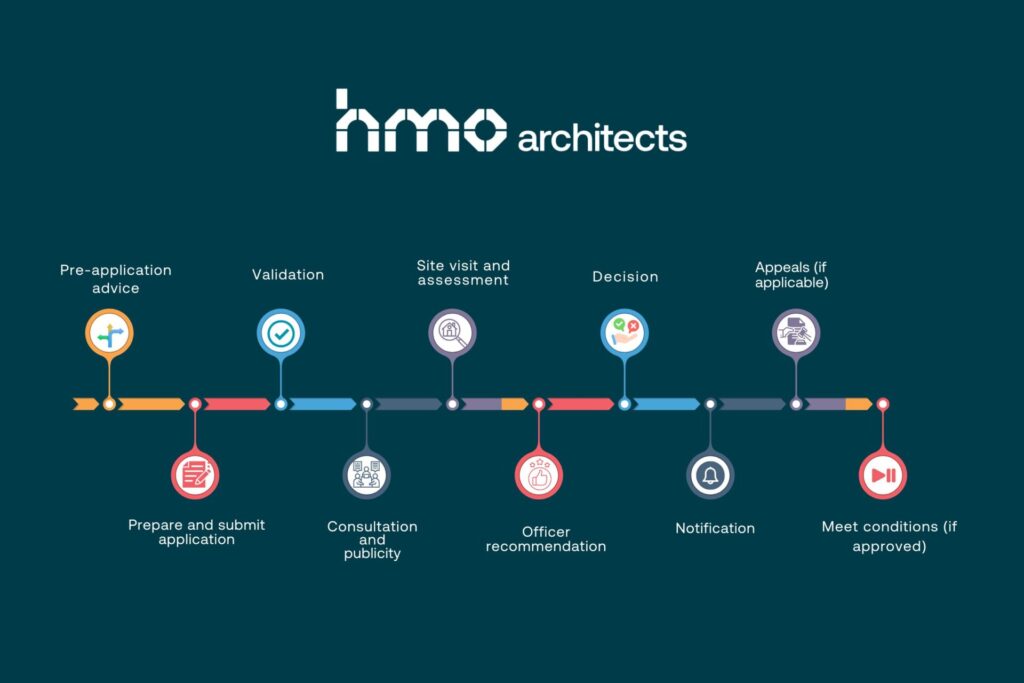

HOW TO APPLY FOR PLANNING PERMISSION

Getting your application right takes a few key steps. Start by spotting the potential roadblocks before you invest too much time and money. Then, it’s time to submit the plans, including detailed drawings showing your vision for the space. The council typically takes about two months to decide, though more complex projects might need longer. What if they say no? Don’t lose heart —you can appeal or choose to improve your chances of approval from the start.

1. Do a pre-application consultation:

Meeting with the local planning authority (LPA) early can help clarify requirements and assess the likelihood of approval.

2. Prepare and submit your application:

This includes gathering the necessary drawings, floor plans, and documents outlining the intended conversion, completing the application form, and paying the fee (which varies by location and project scope).

– During the validation stage, the local authority checks all required documents and the application, requesting adjustments if needed.

3. Await the decision:

Though complex projects may take longer, the council usually responds within eight weeks.

– During this time, the council launches the next stage, including consultation with neighbours and specialists and public notifications.

– A planning officer typically visits the site and gathers relevant information —assessing the application, considering planning policies, consultation and public responses— to emit a recommendation.

4. Implement recommendations or appeal if necessary:

The authority will send a formal decision detailing any conditions or reasons for refusal.

– If the permission is granted with conditions, you must ensure all conditions are met before development can start.

– If the application is refused, you have the right to appeal. Consulting a planning specialist or solicitor can improve the appeal’s success.

COMPLIANCE AND LEGAL REQUIREMENTS FOR HMOS

To meet local authority standards, licensing is an essential consideration for HMOs. While licensing requirements vary depending on the local council, an HMO must seek consent in the following circumstances:

– The property provides accommodation for five or more tenants from two or more households —this is known as mandatory licensing.

– HMOs with three to four occupants when required by the local authority—so-called selective licensing.

– If the local authority has expanded the requirements to cover more areas or whole districts—additional licensing.

We always advise checking with the local authority to determine the specific HMO requirements, even for smaller properties with fewer occupants.

Licenses are typically valid for five years before renewal. During this time, the property must comply with strict safety, amenity, and space standards. You can learn all the requirements from our comprehensive review of the HMO regulatory framework.

Additionally, HMOs must meet the standards of the Housing Health and Safety Rating System (HHSRS). This system outlines the heating requirements and other safety considerations.

CONVERTING COMMERCIAL PROPERTIES: LESSONS FROM SUCCESSFUL CASE STUDIES

Ever worried about investing time and money into a conversion, only to have applications rejected, discover the project isn’t feasible—or worse, finish the work and struggle to fill the rooms? These are common challenges for property investors, especially when converting commercial spaces into residential use.

PROPERTY VS DEMAND

In one recent case, we evaluated a historic corner property previously used as office space, which initially seemed ideal for a high-density HMO. However, after researching the local market, it became clear that demand for HMO rooms in this location was low, making the original plan less viable.

Instead, we created a plan that balanced variety and functionality and advised our client to create a mix of self-contained studio flats and maisonettes. We incorporated a mansard roof to blend with the original structure, enhancing the building’s landmark presence while maximising usable space. The final solution matched local rental needs and settled Borough Road for long-term success.

I always emphasise how engaging with the local planning authority is essential for addressing issues promptly —from compliance to errors that could cause expensive fixes. With this project, working with LPA proved key to bringing the vision to life. Early meetings with planners were challenging, as they had encountered multiple unsuccessful proposals for this site. However, with our approach, respecting market demands and leveraging the building’s historic character, we secured approval for our client.

TURNING ‘NOT ALLOWED’ INTO APPROVAL

Repeated planning refusals are frustrating and a typical result of inadequate planning strategies—it can feel like all avenues have been exhausted. That was the case with a five-story historical townhouse featuring a basement and ground-floor retail space. Despite three prior attempts by the client to gain approval to add more bedrooms, previous applications were denied—mainly due to issues with converting the basement into a residential space, as this was not typically permitted on this road.

Our client’s vision was to increase the number of en-suite bedrooms from seven to nine, making the most of the property’s potential. When our team took on the project, we focused on meeting heritage and space standards while showcasing a clear and functional plan. We reimagined the basement layout, proposing a strategy to introduce natural light into the space, which was instrumental in addressing the council’s concerns.

We secured planning approval on our first attempt thanks to a well-coordinated approach. To complete the design in Kilburn High Road, we incorporated a dormer extension to add space on the top floor, and we carefully planned for fire safety. Through strategic planning and respect for heritage standards, we turned a previously “impossible” project into a well-balanced, compliant design, maximising space and functionality.

Check out our showcased projects and get inspired

HOW TO DESIGN AN HMO CONVERSION FOR MAXIMUM INCOME

Once you decide to take on a conversion, it’s time to make the most of your HMO space. My first advice is to give every room a clear and functional purpose. Creating as many bedrooms as possible is tempting, but balance is critical. For instance, private bathrooms can make rooms more appealing, as long as it doesn’t sacrifice the overall quality of the room. Essentially, well-designed shared spaces often determine whether tenants stay long-term. A cramped kitchen or living room might “save” space, but it could cost you in tenant turnover.

EFFECTIVE LAYOUT AND SPACE OPTIMISATION

Creating efficient yet inviting spaces that maximise each square metre and comfort is essential to realising your property’s full potential. Here are some design strategies for your HMO to help you command premium rents:

1. Transform unused spaces to enhance profitability. For example, a loft conversion for additional rooms can lead to higher occupancy.

2. Optimise room layouts for functionality and comfort. Provide well-designed configurations that maximise space usage, including options for large-size beds, desks, and ample storage.

3.Incorporate en-suite bathrooms where feasible. While challenging, en-suites can significantly increase room value and tenant satisfaction.

4. Focus on high-quality finishes and materials in bathrooms and kitchens. These areas greatly influence tenant decisions.

5. Invest in durable, stylish furniture that can withstand regular use while maintaining its appearance.

6. Maximise natural light and ensure proper ventilation in all rooms.

7. Create inviting communal spaces with thoughtful interior design, using colour psychology to set the right mood.

8. Consider eco-friendly design elements and energy-efficient appliances to attract environmentally conscious tenants.

9. In kitchens, exceed minimum worktop space, storage, and appliance requirements.

10. Optimise and design for your target market; after all, students’ needs are significantly different from those of professionals seeking high-end accommodation or travellers looking for a home feeling with premium services.

Conversion projects can work out incredibly well but require resources, experience and careful planning. My second tip is to work with an experienced team. Everyone appreciates a ‘bargain’, but cheap often comes with added risks. Expertise can save you money in the long run by avoiding costly errors and optimising designs. Plus, we bring connections with reputable builders, contractors, and suppliers nationwide. Such a network can make a huge difference in finding the right professionals for your project.

FINANCING A COMMERCIAL TO HMO CONVERSION

For most investors, financing is a primary concern in their planning as the costs can be significant. When funding an HMO conversion, your assessment needs to consider the type of loan, mechanisms, criteria and benefits the lender offers. Again, you should take a deeper dive to find the best HMO mortgage option for you; here’s an extract to get you started:

Converting from a commercial space may involve bridging loans for properties needing extensive renovations to meet HMO standards. Many lenders now offer HMO-specific mortgage options with terms tailored to this unique market.

Mortgage options—depending on the HMO size and tenant type, including those qualifying as:

– Standard (up to 6-bed) and large (7+ bed)

– Multi-unit (those with self-contained units)

– Limited Company

– Student and professional housing

– Holiday lets

Qualification criteria include minimum rental income requirements, experience as a landlord, target tenant market considerations, and specific regulations based on the number of lettable rooms.

BUDGETING FOR UNEXPECTED COSTS

It’s common for conversions to run over budget due to unexpected costs such as additional structural or compliance upgrades. Creating a contingency fund of at least 10-20% of the estimated budget can help investors navigate unexpected expenses without jeopardising the project.

IS A COMMERCIAL TO HMO CONVERSION RIGHT FOR YOU?

The commercial-to-HMO conversion process can yield impressive returns, providing investors with a sustainable income source and significant capital growth opportunities. Is it the right move for you? It depends on several factors, including your local market, financial situation, and willingness to manage a more complex property. While these projects work well when planned carefully, they require time, patience, and attention to detail.

YOUR NEXT STEPS TO COMPLETE A SMOOTH HMO CONVERSION

Managing a conversion requires solid experience, and our team of architects can guide you through the entire process, from pre-purchase advice to final construction, ensuring a smoother development journey.

Reach out to discuss your property strategy today. Not ready yet? Give us a call to start exploring your options.

The content on this blog is for general informational purposes only and should not be taken as legal, tax, financial, or investment advice. We recommend consulting directly with qualified professionals for tailored guidance on your specific investment needs.

Giovanni is a highly accomplished architect hailing from Siena, Italy. With an impressive career spanning multiple countries, he has gained extensive experience as a Lead Architect at Foster + Partners, where he worked on a number of iconic Apple stores, including the prestigious Champs-Élysées flagship Apple store in Paris. As the co-founder and principal architect of WindsorPatania Architects, Giovanni has leveraged his extensive experience to spearhead a range of innovative projects.