Have you ever wondered how some property investors expand their portfolios exponentially within a few years while others struggle to add even a single property? The difference might be less about capital on hand and more about making your money work efficiently—specifically, the strategy known as BRRR. By the end of this guide, you’ll gain actionable insights to integrate the buy, refurbish, refinance, and rent strategies to enable a cycle of continuous growth. Let’s break down the steps and challenges of the BRRRR approach that has turned many ambitious investors into seasoned property entrepreneurs.

WHAT IS THE BRRRR METHOD?

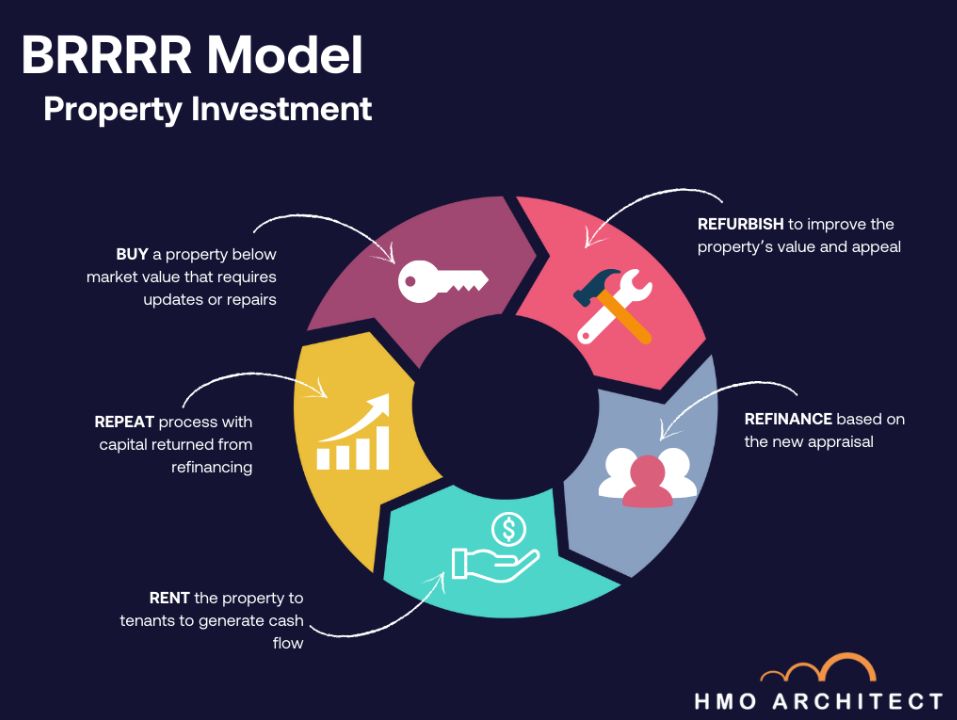

The BRRRR method stands for Buy, Refurbish, Refinance, Rent, Repeat, and is a superior property investment strategy used to maximise capital efficiency and generate long-term rental income. This approach involves purchasing properties that need refurbishment, making the necessary improvements to enhance their value, refinancing them at their new, higher value, and then renting them out. The refinancing step allows investors to pull most, if not all, of their initial capital out to reinvest in additional properties, thereby effectively repeating the process and scaling their property portfolios.

THE BASICS OF BRRR IN REAL ESTATE

Understanding the fundamentals of the BRRR method can provide property investors with a robust framework for generating wealth.

The process begins with acquiring a property that offers the potential for an increase in value through refurbishment. Once the property is renovated, the owner seeks to refinance it based on the new appraised value, ideally obtaining a loan that covers the original buying price and the cost of renovations. This step leverages the property’s increased equity, freeing up capital to then reinvest it. The ‘last’ phase involves renting out the property, thereby creating a continuous income stream that covers the mortgage and provides profit on top—this covers the basic BRRR model; however, investors can expand the strategy further by repeating the process.

The beauty of the BRRRR strategy lies in its ability to recycle capital, allowing you to grow your property portfolio without continually injecting new funds. By refinancing, you retrieve most of the money invested, which can then be used to repeat the process. This method can speed up the investment cycle and maximise the return on investment (ROI) through leveraging, making it an attractive strategy for efficiently expanding real estate investments.

In the UK, investing in property is particularly appealing due to the robust rental market and the potential for property appreciation. However, the BRRRR approach requires a good understanding of the real estate sector, renovation costs, refinancing rules, and tenant management. Navigating these areas can be challenging for newcomers, but mastering the BRRRR method can be quite lucrative with the right strategies and partnerships.

BREAKDOWN OF THE BRRRR STRATEGY

One of the most frequent questions new investors ask is, “How does the BRRRR method work?” Here’s the simplified breakdown:

- Buy: Purchase a property below market value.

- Refurbish: Make the necessary renovations and improve the property’s value and appeal.

- Refinance: After the property’s value increases due to renovations, refinance it based on the new appraisal.

- Rent: Rent the property to generate cash flow.

- Repeat: Use the capital returned from refinancing to repeat the process.

BRRRR MODEL STAGES EXPLAINED

This is how the BRRRR cycle can potentially help investors expand their property portfolios by recycling their initial capital while also increasing equity and rental income. Let’s look at each stage and the critical aspects of making the BRRRR model work.

THE BUY STEP DONE RIGHT

The first and perhaps the most critical step in the BRRRR method is the property purchase. The ‘Buy’ phase must start by identifying an undervalued property—typically because it requires refurbishment or is in a less desirable condition.

Making a successful start for a BRRR hinges on thorough market research to pinpoint properties with significant potential for increased value post-renovation.

- Investors need to assess the cost of necessary upgrades against the potential increase in property value and rental income.

- Buying the property involves negotiating purchase prices to ensure the investment remains cost-effective once all subsequent expenses are considered.

- The aim is to acquire a property at a price that allows room for the cost of refurbishments while still promising good returns once the property is refinanced and rented out.

REFURBISHING FOR VALUE GROWTH

After acquiring the property, the next step is refurbishment. In this phase, you must make necessary repairs and upgrade the property to enhance its appeal to future tenants and increase its overall value.

- Strategic refurbishments might include modernising kitchens and bathrooms, improving the property’s energy efficiency, and enhancing curb appeal.

- It’s essential to keep refurbishment budgets in check while ensuring the upgrades add real value.

- The aim is to decide which renovations will offer the best ROI—balancing aesthetic improvements with functional upgrades that raise the property’s market value and rental desirability.

HOW TO REFINANCE EFFECTIVELY

Once the property is renovated and its value increased, refinancing allows you to withdraw a significant portion of your initial investment. This stage requires obtaining a new mortgage at a higher value based on the updated property appraisal.

- To refinance effectively, you must demonstrate to lenders that the property’s new value justifies the increased loan amount, and that the rental income will cover mortgage payments.

- This may involve presenting renovation details, before and after appraisals, and a solid rental management plan.

- Successfully refinancing frees up capital you can reinvest in additional properties, thus enabling the BRRRR strategy.

RENTING STRATEGIES IN BRRR

The ‘final’ step of the BRRR method is renting out the refurbished property. Effective rental strategies involve setting a competitive yet profitable rental price, identifying your ideal tenants and marketing the property accordingly, and managing the property efficiently to maintain its value and ensure steady rental income.

- Proper execution of this phase is instrumental as the income generated must cover the new mortgage and expenses while providing a profit.

- Consider employing property management services to handle tenant relationships and maintenance, ensuring the investment remains passive and manageable as you scale up your portfolio.

REPEATING THE BRRR

Just because you can doesn’t mean you should; that’s a fact and valid strategy when it fits your financial and risk management goals. However, this step effectively diversifies and enables property portfolios to scale up, a favoured approach for the many determined investors out there sizing opportunities to create wealth.

Buy, Refurbish, Refinance, Rent, Repeat, each of these steps requires careful planning and execution. By understanding the complexities of each phase, you can maximise their efficiency and profitability, turning a single property investment into a growing portfolio of income-generating assets.

CALCULATING RETURNS AND EQUITY IN BRRRR

A leading aspect of the BRRR method is understanding how to calculate the returns and equity built through the process. After refurbishing and refinancing a property, the equity is essentially the difference between the new appraised value and the outstanding mortgage amount. To calculate this, you first need an accurate new appraisal post-refurbishment. Then, subtract any remaining mortgage balance from this appraised value. The result is the equity you’ve generated.

To demonstrate the value created through the BRRR process, let’s consider the following scenario:

An investor purchases a dilapidated house in Liverpool, which is ideally located and has the potential to be converted into a 9-bed HMO.

- Buy: The property is purchased for £180k.

- Refurbish: The total cost for full renovation and additional expenses comes to £250k.

- Total Investment: The combined total initial investment thus amounts to £430k.

- Rent: Upon completion, the property is converted into a 9-bed HMO, with each bed rented out for £110 per week. This setup generates an annual rental income of approximately £50,400.

- Commercial Valuation: Based on the income and the improved condition of the property, it receives a commercial valuation or Gross Development Value (GDV) of £600k.

- Refinancing: The property is refinanced at a 75% Loan-to-Value (LTV) ratio, which allows the investor to withdraw £450k.

- Equity: After refinancing, the equity remaining in the property is £150k, calculated as the new appraised value (£600k) minus the new mortgage (£450k).

|

BRRR Financial Breakdown (example) |

Amount (£) |

| Property Purchase Price | 180,000 |

| Renovation Costs | 200,000 |

| Consultations and Other Expenses | 50,000 |

| Total Initial Investment | 430,000 |

| Annual Rental Income | 50,400 |

| Gross Development Value (GDV) | 600,000 |

| Refinanced Amount (75% LTV) | 450,000 |

| Equity Left in Property | 150,000 |

This equity shows the actual value created through the process —by reinvesting it into new BRRR projects, you can essentially roll over the profits and leverage growth.

COST MANAGEMENT IN BRRR PROJECTS

Effective cost management is critical in the BRRR strategy, especially during the refurbishment phase —which costs you must calculate ahead of the buying negotiations. Here are several methods to manage costs effectively:

- Detailed Planning and Budgeting: Before beginning any work, you must have detailed plans and budgets ready. Break down the costs for each phase of the refurbishment to avoid overspending. Use professional quotes from reliable builders and your own experience to guide your estimates.

- Contingency Funds: Always include contingency funds of around 10-20% of the total project to cover unplanned expenses. Always prepare for unexpected issues (not uncommon in refurbishments); setting a budget to handle these without derailing your project is crucial.

- Value-Adding Improvements: Focus on renovations that significantly increase property value or appeal. Prioritise structural repairs, aesthetic improvements, and updates that improve the property’s energy efficiency. These improvements are vital in attracting your ideal tenants.

- Vendor Relationships and Negotiations: Build strong relationships with contractors and suppliers and negotiate prices where possible. Experienced investors often consider bulk-buying materials when planning multiple projects.

- Regular Monitoring and Review: Keep track of expenses as the project progresses. Regular monitoring can help you stay on budget and make timely adjustments to your plan when needed.

Remember, careful financial management underpins the success of the BRRR strategy, enabling investors to grow a property portfolio sustainably.

IMPLEMENTING BRRR IN THE UK

The BRRR method, initially popularised in the US, has specific nuances when applied in the UK. Effectively leveraging the BRRR strategy in our competitive landscape requires a solid understanding of market forces —supply and demand— and property laws at national and local levels.

MARKET TRENDS AND LOCATION

Property values and rental demand can vary across regions and zones significantly, making the success of a BRRR heavily dependent on choosing the correct location. Investors must conduct thorough market research to identify areas with rising property values and strong demand. For instance, regions undergoing regeneration or with planned infrastructure improvements can be particularly lucrative.

- Start by examining broad economic indicators influencing property values and rental markets. These factors include employment rates, income levels, and economic growth forecasts for the area.

- Review local government and planning authority websites for information on future development projects. These can include new commercial centres, improvements in transportation infrastructure and services, or residential developments likely to boost property values in the area.

- Use real estate tools and platforms to gather insights into property price trends and rental yields. Websites like Rightmove, Zoopla, and local estate agents’ databases can provide valuable data on average property prices, historical price changes, and rental rates in different areas.

- Real estate agents can provide insights and market data not always captured in broad reports. By networking with industry professionals, you can gain insights into which areas are gaining interest from renters and potential future developments.

- Keep an eye on rental listing sites to monitor how quickly properties are being rented out, which indicates strong rental demand. Also, note the average rental prices and how they are trending.

PROPERTY TYPES

Certain types of properties may offer better potential for the BRRR method. For example, Victorian and Edwardian properties are often excellent candidates for refurbishment due to their build quality and potential for value addition through modernisation. Conversely, however charming, listed properties may pose additional challenges due to regulatory requirements, making them less likely to attract BRRRR investors.

FINANCING

Access to adequate funding is a decisive factor, as is understanding the lending criteria and having a solid exit plan to face market turns and minimise risk. A common strategy is using buy-to-let mortgages for the initial purchase. It’s important to note that lenders are likely to scrutinise the viability of the refinancing step based on the estimated post-refurbishment value and rental income.

LEGAL AND REGULATORY CONSIDERATIONS

If you want to make the BRRRR method work, you’ve got to navigate the regulatory landscape, including property laws, planning permissions, and tax implications. Adherence to legal requirements is essential to protect your investment, helping you guard the sustainability and growth of your property portfolio. Central directives to consider involve:

- Planning Permissions and Building Regulations: Before commencing any refurbishment works, ensure compliance with local planning permissions and building regulations. Modifications that alter the building’s structure or involve a change of use might require approval from the local council.

- Licensing: If the property is intended as a House in Multiple Occupation (HMO), you may need an HMO license from the local authority. This is mandatory for HMOs rented out to five or more tenants who form more than one household. However, local authorities can (and often do) implement more specific and stringent requirements for this type of rental, such as Article 4 Direction.

- Tax Considerations: Understanding the tax implications of buying, refurbishing, refinancing, and renting out properties is essential. This includes stamp duty on purchase, potential capital gains tax on sale, and income tax on rental income. Remember that the structure of your investment (individual, partnership, or company) can significantly affect your tax liabilities.

- Safety and Compliance: UK law requires that rental properties meet specific safety standards. This includes obtaining gas safety certificates annually, ensuring safe electrical installations, providing Energy Performance Certificates (EPCs), and complying with fire safety

COMBINING BRRR WITH OTHER PROPERTY INVESTMENT MODELS

Integrating the BRRR method with other real estate investment strategies can optimise returns and spread risk. One such combination is investing in HMOs, which brings additional potential benefits, such as creating multiple income streams from a single property, reduced void risk, and increased income.

- Complementing BRRR with HMOs: Refurbishing a property through the BRRR method to convert it into an HMO can significantly increase rental income. The first principle is to ensure the property layout and renovation works are suitable for multiple tenants and comply with HMO regulations, typically stricter than typical residential properties. This approach maximises cash flow, which is a high priority to cover the refinanced amount and accelerate the equity buildup.

- Mixed-Use Developments: Another strategy is to buy, refurbish and refinance properties developed into mixed-use buildings. For instance, you could combine HMOs and short-term (Airbnb-type) rentals or retail space on the ground floor with residential units above. This BRRR approach further diversifies income sources and reduces dependency on a single market.

- Development and Sell Strategy: While the traditional BRRR focuses on holding properties, combining it with development and quick sales can also unlock significant capital gains. After refurbishing and possibly expanding a property, an investor could sell it at increased value instead of refinancing. This alternative can be particularly lucrative in high-demand markets and a way to diversify the investment strategy.

Combining the BRRR method with other investment strategies can enhance returns and lay the foundation of a resilient investment portfolio. These advanced strategies require thorough market knowledge, careful financial planning, and adherence to legal frameworks but offer substantial rewards for the determined investor.

COMMON CHALLENGES IN BRRRR

While its potential for high returns makes it a favourite among property investors, the BRRR method comes with its own set of challenges. Here are some common obstacles and strategies to overcome them:

- Underestimating Renovation Costs and Timelines: One of the most common pitfalls is underestimating the cost and scope of necessary renovations. To mitigate this, perform thorough inspections before purchasing a property and consult with experienced contractors to get accurate renovation estimates and quotes.

- Cash Flow Management: Managing cash flow effectively is vital, especially if the refinanced money does not cover all the initial costs. A buffer fund should —ideally— provide the necessary cover for any shortfalls and unexpected expenses.

- Refinancing Challenges: Not all properties will appraise at the expected value after renovation, which can complicate refinancing. To avoid this, invest in detailed market research before purchasing a property to build an accurate and objective picture of the potential for value appreciation.

- Tenant Management: Finding and managing tenants can be time-consuming. Implementing rigorous tenant screening processes and possibly using property management services can help maintain a stable rental income in the long term.

- Regulatory Compliance: Staying compliant with property and housing laws and regulations is essential. This includes adhering to safety codes, obtaining necessary permits for renovations and operation (e.g. HMO licensing), and understanding landlord-tenant laws.

TAKEAWAYS TO INVESTING IN PROPERTY THROUGH THE BRRRR MODEL

Buy, Refurbish, Refinance, Rent, Repeat method is a powerful strategy for property investors aiming to maximise their returns while recycling capital for new investments. By meticulously planning each phase—buying undervalued properties, refurbishing them tactically, refinancing based on increased values, and renting for optimal cash flow—investors can steadily build and expand their real estate portfolios. At its core, the fundamentals of property investment hold:

- Applying the BRRRR strategy demands a deep understanding of property investment complexities, including challenges, risks and potential ROI, property valuation, renovation costs, refinancing rules, regulatory requirements, and rental market trends.

- Choose the location based on primary indicators, including economic growth, employment rates, and rental demand. A principal guideline is focusing on areas with potential for appreciation and strong rental yields.

- Look for undervalued properties with potential for significant improvement through renovations. These properties often yield the best returns under the BRRR method.

- Make sure you have enough capital to cover the initial purchase and refurbishments. This might involve saving up or securing a loan. It’s also essential to have a contingency fund to cover unexpected expenses.

- Building relationships with reliable contractors, real estate agents, and mortgage brokers early on can streamline the entire process. These professionals will provide the expertise and support needed to make informed decisions.

Are you looking to refine your property project or assess how viable your vision is? We have a wealth of resources available to enhance your knowledge base, from comprehensive guides like Strategies To Maximise Your HMO Profits to interactive webinars.

Gain tailored advice and a powerful partnership to realise your investment goals, backed by a 97% planning success rate and over 15 years of experience. Reach out to discuss your property strategy or contact us for a free discovery call to connect with our team.

Ryan Windsor, Development Director and co-founder of HMO Architect, brings over 15 years of specialised experience in HMO development to the table. Having consulted on nearly 2,200 projects, Ryan is a highly seasoned HMO landlord with a vast and influential property network. He began his real estate journey at just 17, rapidly amassing a wealth of experience that sets him apart in the industry. Beyond his professional successes, Ryan is passionately dedicated to giving back, leading numerous charitable initiatives that make a meaningful impact on local communities.