The UK property market offers various paths to profitable investing, and flats and studios deserve serious consideration. Lower entry costs and steady demand are only starting points for why these compact units offer an appealing mix for investors. Determine whether flats and studios align with your investment goals. In this guide, we explore their potential as profitable investments, weighing the advantages against the considerations and the paths to build your portfolio.

ARE FLATS AND STUDIO APARTMENTS: A VIABLE INVESTMENT FOR STEADY RETURNS?

Flats and studio apartments are strong contenders in the UK property market; they can offer steady tenant demand and attractive rental yields. While they come with unique challenges, their affordability and compact design make the case for stable returns, especially in urban areas, and as a long-term strategy.

THE PROS

Tenant demand is a major draw for flat and studio investments, particularly in urban areas where affordable housing is scarce. These properties cast a wide net, attracting renters from different walks of life—young professionals seeking their first independent home, couples starting out, downsizers looking to simplify, and students looking for convenient accommodation near campus. This diverse appeal helps ensure consistent occupancy rates.

The financial calculation also works in favour of flats and studios. Their lower purchase prices compared to houses mean investors can enter the market with less capital while still commanding attractive rents relative to their value. Even studio apartments, which typically target cost-conscious renters, can generate reliable income streams. The key lies in matching your property’s quality and amenities to your target tenants, whether that’s budget or premium markets.

Some investors shy away from smaller spaces, but the compact nature of flats and studios can boost your bottom line. These properties often deliver higher yields per square meter than larger units, while their size helps keep maintenance and investment costs in check. The trick is maximising every inch through smart design—when done right, these efficient spaces can outperform larger properties in terms of return on investment.

THE CONS

While they offer potentially higher yields and other benefits, investors must assess these alongside challenges. Flats and studios in the UK that operate under leasehold agreements have long-term implications. Lease agreements typically involve additional costs, such as service charges and ground rent, which can reduce net returns. However, the new Leasehold & Freehold Reform Act is set to shift these concerns, for instance, by increasing the standard lease extension to 990 years —effectively reducing the ground rent to a symbolic sum.

Another consideration is maintenance costs, for example, when entering the market with an older property. These properties may require frequent repairs, and poorly managed buildings can increase expenses. Moreover, older buildings without modern amenities may impact tenant demand and grow in value at a slower pace.

DO FLATS INCREASE IN VALUE?

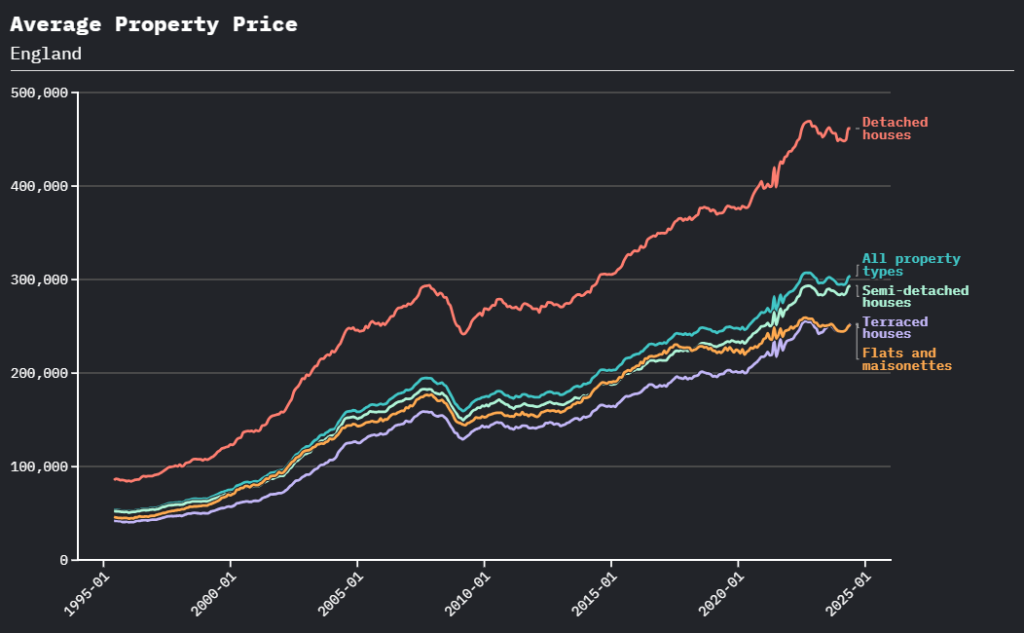

The UK property market has proven its resilience. Even with notable setbacks like the 2008 financial crisis, real estate values have maintained an overall upward trajectory. This consistent long-term appreciation helps explain why property continues to attract investors looking for wealth preservation and growth.

Looking at Land Registry figures reveals an interesting dynamic: while flats typically cost less than houses, they may see slower capital appreciation over time compared to detached and semi-detached properties. Yet this apparent downside comes with a hidden advantage. The lower purchase price allows landlords to keep monthly rents within reach for more potential tenants.

This affordability is where flats really shine from an investment perspective. Their moderate price tags allow landlords to charge rents that represent a higher percentage of the property’s value, opening the door to stronger rental yields. So, while you might see less dramatic price appreciation than larger properties, flats can deliver attractive returns through steady rental income—particularly appealing to those focused on regular cash flow rather than solely on long-term value gains.

The growth potential of flats and studios isn’t only a matter of “buy and wait”—it depends on several crucial factors. While we can’t cover every detail here, understanding the basics will help you make better choices.

Location remains the basis of property value growth. Flats near transport links in high-demand urban areas tend to appreciate faster, while properties in up-and-coming neighbourhoods can see substantial gains as the area develops. However, even a well-maintained flat in the wrong location might struggle to deliver the desired returns. What makes a location “right” goes beyond just its current status—you need to consider its future potential and development plans.

The property’s condition and broader market trends also play vital roles in value appreciation. New builds with modern features like energy-efficient features can command premium rents and values. Meanwhile, cultural shifts toward urban living and practical, flexible spaces strengthen the case for flats and studios. Today’s renters often prioritise affordability and convenience over size, making these compact properties increasingly attractive to a growing segment of the market.

NEW-BUILT VS OLDER PROPERTIES

Flats and studios offer more investment paths than just buying into existing apartment blocks. One particularly effective strategy is converting houses into multiple units. This approach gives you complete control over the property’s transformation—from layout design to modernisation levels—letting you precisely target your chosen market. This approach can also deliver a long-term perspective in your portfolio; for example, splitting the titles means you can sell units individually later, adding flexibility to your exit strategy.

The property’s age brings its own mix of challenges and opportunities, from design to maintenance. Here’s how you can draw a simplified comparison to start defining your investment approach:

| Opportunity/Challenge | New Builds | Old Properties |

|---|---|---|

| Energy-efficient measures in place | More likely | |

| Compliant with modern building standards | More likely | |

| Reduced utility costs | More likely | |

| Increased appeal to eco-conscious tenants | More likely | |

| Larger living spaces | More likely | |

| Appealing to tenants prioritising size and comfort over savings | More likely | |

| Historical character and larger spaces can open into the premium market | More likely | |

| Include warranties, minimising short-term repair costs | More likely | |

| Their modern amenities make them popular for buy-to-let investments | More likely | |

| Require higher maintenance and potential modernisation | More likely |

HOW TO INVEST IN FLATS AND STUDIO APARTMENTS IN THE UK

While property investment offers many paths—from BRRR (buy-refurbish-refinance-rent) to shared ownership and no-ownership with REITs (Real Estate Investment Trusts)—success in any approach demands a clear strategy.

When building a property portfolio, start by conducting thorough market research and identify areas with strong tenant demand. In the context of flats and studios, urban centres and locations near transport hubs are traditionally hotspots, enabling higher rental yields and stable occupancy rates. Additionally, analyse tenant demographics to align your property with market needs, such as young professionals and downsizers who value convenience over space.

The financial evaluation needs to work in your favour before you commit. Start by mapping out all upfront costs, from purchase price to renovations, and weigh these against projected rental income and appreciation potential. Properties in prime locations or with modern amenities often justify higher initial investments through better returns. Remember, it’s more than just running the calculations—any analysis must incorporate market trends and local performance data to validate the assumptions.

Understanding legal requirements is crucial, particularly regarding property classification and compliance. Whether your property falls under Use Class C3 (residential) or C4 (HMOs) will significantly impact your obligations. HMOs face stricter controls, including specific standards for room sizes, fire safety, heating and licensing regulations. Your local authority may set additional requirements, and getting familiar with the compliance rules early is essential to prevent costly mistakes. Even standard flats must meet various regulations, so factor compliance costs into your investment planning.

HOW TO FAST-TRACK A PROPERTY PORTFOLIO?

Some investors accelerate their market entry by purchasing pre-built buy-to-let portfolios, which offer immediate rental income through properties that are already tenant-ready. While this approach can fast-track your investment goals, it requires substantial capital and careful risk assessment. Working with property specialists during your due diligence can help you spot opportunities and mitigate risks.

Consider the benefits of diversification—the foundation of a stable property investment strategy. By spreading your investments across different locations and property types—mixing, for example, flats, houses, and commercial units—you protect your portfolio against market swings. This approach helps ensure that a downturn in one area won’t destabilise your entire investment.

FLATS AND STUDIOS VS OTHER INVESTMENT PROPERTIES

Different property types come with varying levels of management intensity and return potential. Standard flats and studios typically offer the most straightforward path, requiring less hands-on management than other options. With individual leases and fewer regulatory demands, these properties simplify tenant relationships yet can provide consistent, long-term rental income, particularly in high-demand urban areas. Let’s take a broader look at how they stand against other popular strategies.

Bedsits and HMOs can potentially generate higher yields through room-by-room rentals, helping protect against complete income loss during void periods. However, HMOs come with stricter regulations, more complex tenant relationships, and higher operational demands—making them better suited for hands-on investors ready to handle additional landlord responsibilities or work closely with management agencies. On the plus side, these properties allow for customised layouts and targeted tenant profiling, from basic shared facilities to premium individual spaces. While often classified as small accommodations, strategic design can enhance the appeal of these units, going from loft conversions to complete house-to-HMO transformations.

The model known as serviced accommodation represents a distinct investment approach, targeting the short-stay market of tourists and business travellers. While these properties can generate higher rental yields than traditional lettings, they demand intensive management—from coordinating daily cleanings to handling constant guest turnover. The increased income potential comes with higher operational costs and the need for consistent marketing to maintain bookings. Short-term serviced units can indeed deliver significant returns, particularly in tourist hotspots and business districts.

Studios —typically self-contained units combining sleeping, living, and kitchen spaces into one cohesive layout— and flats strike an appealing balance between returns and effort. They can provide steadier, long-term returns with reduced operational complexity. Individual tenants on fixed leases simplify management and reduce the need for constant attention. As for their market, these properties attract independent tenants seeking privacy and convenience, and when appropriately designed, they can compete in a high-end market for premium rentals, providing a consistent income and increasing the portfolio value.

DESIGN CONSIDERATIONS FOR FLATS AND STUDIOS

When comparing flats and studios to HMOs, factors like layout, location, and target market significantly influence their return on investment (ROI). However, the design of these properties plays a critical role in realising their full potential.

For flats and studios, optimising space is key to attracting tenants. Open-plan layouts in studios, for example, can make smaller units feel more spacious and appealing. Adding modern features, such as energy-efficient systems or upgraded kitchens, enhances tenant satisfaction and improves long-term property value. These innovations increase desirability, helping secure higher rental yields and lower vacancy rates.

In HMOs, the balance between communal and private spaces is vital. Thoughtful layouts prioritise functionality while complying with regulations—like standards for fire doors and room size—to create a safer and more appealing living environment. Enhancements such as ensuite bathrooms, ample storage, and energy-efficient upgrades improve tenant satisfaction and retention, directly boosting the property’s profitability.

Flats and studio apartments represent a versatile and rewarding opportunity in the UK property market. By understanding the opportunities and challenges of these investments and leveraging expert services, you can maximise returns, mitigate risks, and build a sustainable portfolio.

GET IN TOUCH WITH US AND BUILD A PROFITABLE INVESTMENT STRATEGY

Strategic investment in property design, whether for flats, studios, or HMOs, ensures your asset remains competitive in the rental market. With services like feasibility studies, architectural design, and end-to-end project coordination, you can transform your property into a high-performing investment that’s both profitable and hassle-free. Get in touch to learn how we can help.

Take the first step towards achieving your investment goals by making well-informed decisions and working with trusted experts. Reach out to discuss your property strategy.

The content on this blog is for general informational purposes only and should not be taken as legal, tax, financial, or investment advice. We recommend consulting qualified professionals for tailored guidance on your specific investment needs.

Ryan Windsor, Development Director and co-founder of HMO Architect, brings over 15 years of specialised experience in HMO development to the table. Having consulted on nearly 2,200 projects, Ryan is a highly seasoned HMO landlord with a vast and influential property network. He began his real estate journey at just 17, rapidly amassing a wealth of experience that sets him apart in the industry. Beyond his professional successes, Ryan is passionately dedicated to giving back, leading numerous charitable initiatives that make a meaningful impact on local communities.