Property investment has always been a popular choice for those looking for strong financial returns. As the Airbnb-type continues to gain popularity, more HMO investors are eyeing the short-term rental model as a potential addition to their portfolio. Both the holiday let and residential markets offer lucrative opportunities to boost income, but they also come with unique challenges that demand strategic planning. So, which option best fits your investment goals? In this guide, we’ll explore the key differences between investing in HMOs and Holiday Lets, including Airbnbs.

UNDERSTANDING HMO INVESTMENTS

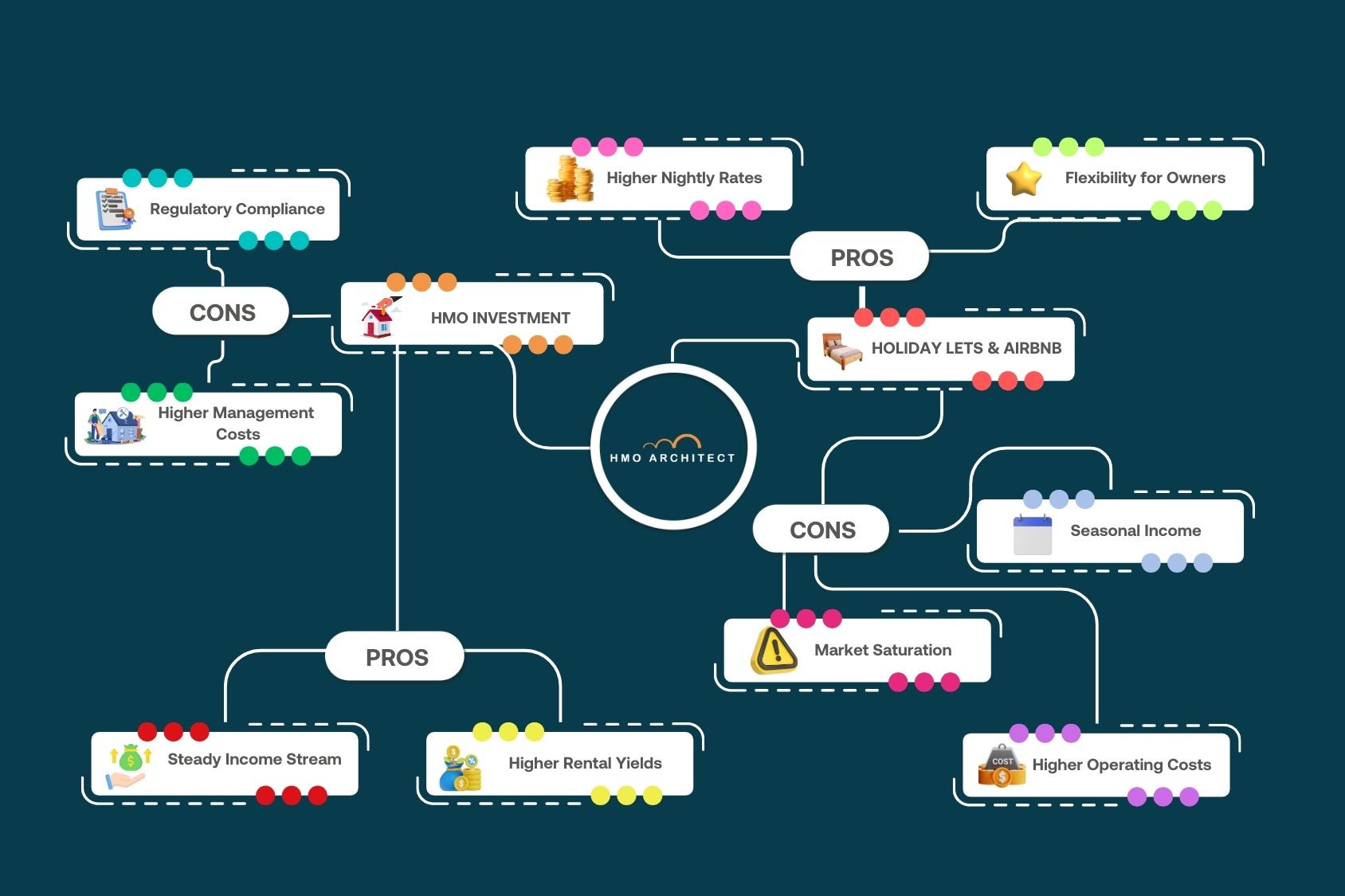

HMOs, or Houses in Multiple Occupation, are properties where multiple tenants rent separate rooms but share common areas like kitchens and bathrooms. The main advantage of HMOs is their potential for higher rental yields compared to traditional single-family buy-to-let properties. By leasing out individual rooms, you can maximise rental income and lower the risk of having a completely vacant property.

FINANCIAL BENEFITS OF HMOS

- Higher Rental Yields: Because you rent out each room individually rather than leasing the entire property as a single unit, HMOs typically provide much higher rental yields than what you’d expect with standard buy-to-let properties. Depending on factors like the area and the quality of the accommodation, HMOs have reported yields of 7.2%.

- Steady Income Stream: With multiple tenants, your income is more stable. Even if one tenant moves out, your HMO still earns money from the other occupants, reducing the financial strain of vacant periods.

- Demand Stability: There is a consistently high demand for affordable, shared housing, especially in urban areas and among students and young professionals. This strong demand provides substantial capital value growth over time and stability—even during economic downturns.

CHALLENGES OF HMO INVESTMENTS

- Regulatory Compliance: HMOs are subject to stringent regulations, including licensing requirements, fire safety and housing standards, mandatory inspections, as well as deal-breaker policies for HMOs, and Article 4 Direction.

- Higher Management Costs: Managing an HMO can be time-consuming and costly, with regular maintenance and tenant turnover.

- Tenant Turnover: With multiple tenants, landlord responsibilities increase, and there is a higher likelihood of disputes or turnover, which can increase management burdens.

If this were your first HMO project, know you can ease these challenges with adequate planning. Keeping your property compliant, effective management strategy, and attracting the perfect tenants for your HMO are all achievable goals.

The HMO regulations got you worried? Get peace of mind with expert guidance at your fingertips.

HOLIDAY LETS AND AIRBNBS: AN OVERVIEW

Traditional Holiday Lets and Airbnb follow a short-term rental model, primarily catering to tourists and business travellers. Similar to serviced accommodation—a versatile model that focuses on both the short and long-term premium markets with a hotel-like offer, Holiday Lets can achieve higher rental income during peak seasons; however, they are typically rented out for a few days or weeks.

FINANCIAL BENEFITS OF HOLIDAY LETS

- Higher Nightly Rates: Short-term rentals can fetch higher nightly rates, particularly in tourist hotspots, leading to significant earnings when demand peaks.

- Flexibility: Owners have the flexibility to use the property themselves when it’s not rented out, making it a dual-purpose investment.

- Tax Advantages: In some instances, holiday lets, in particular furnished holiday lets (FHL), may qualify for favourable tax treatments, such as mortgage interest deductions or allowances for furnishings.

CHALLENGES OF HOLIDAY LETS & AIRBNBS

- Seasonality: Income from holiday lets can be highly seasonal, leading to income volatility. During off-season periods, you might experience low or even no income.

- High Operating Costs: Short-term rentals require more frequent cleaning, maintenance, and marketing efforts, which can reduce overall profits.

- Management Complexity: Running holiday lets often demands a great deal of personal involvement —or hiring a channel manager, a solution better suited for those scaling up to multiple properties. While profitable, the required time commitment should be assessed against the potential returns.

- Market Saturation: The increasing popularity of platforms like Airbnb has made the market more competitive, making it harder to maintain high occupancy rates.

- Regulatory Changes: Planning permission may be needed, especially if the property undergoes a significant change of use. Additionally, with new regulations, like the “Airbnb regulation” confirmed in 2024, the holiday let market will face increased scrutiny and additional controls.

Another approach is gaining popularity among savvy investors: a rental model that takes advantage of increased demand for temporary yet extended stays, like those prompted by the digital nomad community. We’re stepping into the territory of aparthotels.

Remember that before starting any property development, it is essential to consult your local authority. They can provide detailed information about your property’s requirements and potential restrictions, helping you stay compliant and avoid legal issues.

COMPARING HMO VS HOLIDAY LETS

Reserve your spot today for our webinar series, designed to walk you through HMO strategies —from securing compliance to maximising profits.

HMO VS. HOLIDAY LETS & AIRBNBS: WHICH OFFERS BETTER RETURNS?

When comparing HMOs to Holiday Lets, it’s important to weigh both the potential returns and the risks associated with each investment type. So, whether you choose an HMO or an Airbnb-style investment, making informed decisions is key to maximising your returns. Knowing the market conditions in your area, such as the demand for shared housing or tourism trends, will help you choose the property investment that best aligns with your financial goals.

1. CASH FLOW & RENTAL YIELD

HMOs typically offer higher rental yields because they have multiple rent-paying tenants. The steady rental income from several occupants means landlords can enjoy a ‘reliable’ cash flow throughout the year, especially in student or urban areas.

On the other hand, Holiday Lets can generate higher income during peak seasons, but this comes with significant fluctuations. The income stream is heavily influenced by location, tourism trends, and how well the property is managed. While tourist hotspots have higher income potential, investors must be prepared for lower occupancy rates during off-peak times.

2. INITIAL INVESTMENT AND OPERATING COSTS

HMOs often demand a higher initial investment due to safety compliance, possibly more extensive renovations to meet the standards required for multiple tenants, and licensing (when required). Operating costs can also be higher, considering the hands-on management needed, maintenance, utility bills (if included in the rent), and more frequent tenant turnover. However, once the property is stabilised, the costs can be projected more accurately.

In the case of Holiday Lets, the initial costs can vary widely depending on the property’s location and the level of luxury. The operating costs include marketing, property management (if not self-managed), higher maintenance due to frequent use, potentially higher utility costs per tenant turnover, and maintaining the property’s appeal to guests, including additional services like internet and TV licence.

3. REGULATORY COMPLIANCE

HMOs are subject to strict regulations, including safety checks, minimum room sizes, amenities per tenant, and licensing requirements that vary by location. While this adds complexity, it also creates a barrier to entry, potentially reducing competition.

Holiday Lets tend to have less stringent regulations, but this varies by location, especially in high-tourism areas where local councils may impose restrictions or require permits to mitigate the impact on local housing. Some areas have introduced rules, such as limiting the number of nights a property can be rented per year, affecting income potential. Investors need to comply with local regulations and stay informed about regulatory changes, such as the “Airbnb regulation” mentioned earlier.

4. MARKET DEMAND AND STABILITY

HMOs are in high demand in university towns and business hubs. However, market stability can be influenced by local economic factors and demographic shifts.

Demand for Airbnb-style properties is typically seasonal and highly dependent on the property’s proximity to tourist attractions, event venues, and overall travel trends. External factors, such as economic downturns or changes in travel regulations, can also impact the holiday market.

5. LONG-TERM APPRECIATION

The general real estate market conditions can influence the appreciation of HMO properties. However, due to their intensive use and configurations designed to serve multiple unrelated occupants, the property’s value might not increase as much as that of single-family homes.

In comparison, a Holiday Let has the potential for higher appreciation if it is located in a popular and growing tourist destination. Market value can significantly increase if the area’s tourism infrastructure improves or becomes more popular.

6. TENANT MANAGEMENT AND INTERACTION

HMOs require dealing with multiple tenants who often have different leasing arrangements. Conflicts and high tenant turnover can increase management complexity, another concern for investors and landlords.

With Holiday Lets, the focus is on managing guests who stay for short periods. This requires efficient booking systems, quick turnover processes, and high-quality customer service to ensure positive reviews and repeat business.

7. EXIT STRATEGY

Selling an HMO can be more challenging due to its niche market appeal. Investors might find themselves limited to investors familiar with the HMO market.

On the other hand, a Holiday Let may attract a broader range of buyers, including other investors or private buyers looking for a second or first home, potentially making it easier to sell.

What could your property portfolio look like?

MAKING THE RIGHT INVESTMENT CHOICE

When deciding between investing in HMOs or Holiday Lets, investors must weigh the pros and cons of each option. HMOs usually provide a steady and consistent income, making them a safer bet for long-term stability. On the other hand, if you’re prepared to manage the seasonality and operational demands, Holiday Lets and Airbnbs can deliver high returns, particularly in high-demand locations.

Ultimately, the choice comes down to your investment goals, risk tolerance, and the market conditions of the location you’re looking at. For instance, HMOs may be the better option if you’re looking for steady cash flow with less seasonal volatility. However, if you’re aiming for high returns and are comfortable managing the complexities of short-term rentals, Holiday Lets could be the right fit.

BRING YOUR PROPERTY VISION TO LIFE WITH HMO ARCHITECTS

Ready to transform that outdated property into a stunning holiday getaway, enter the ranks of successful HMO investors, or launch your next property venture? We’re ready to make your property ambitions a reality.

Contact us today for a complimentary consultation with one of our expert architects or reach out to discuss your property strategy. We’re eager to help you navigate the complexities of property investment and optimise your portfolio’s performance.

This content is for informational purposes only. It does not intend to constitute legal, tax, investment, or financial advice. We recommend doing your own research or consulting a professional before making investment choices.

Ryan Windsor, Development Director and co-founder of HMO Architect, brings over 15 years of specialised experience in HMO development to the table. Having consulted on nearly 2,200 projects, Ryan is a highly seasoned HMO landlord with a vast and influential property network. He began his real estate journey at just 17, rapidly amassing a wealth of experience that sets him apart in the industry. Beyond his professional successes, Ryan is passionately dedicated to giving back, leading numerous charitable initiatives that make a meaningful impact on local communities.