Did you know that installing solar panels on your rental property could boost its marketability by as much as 25%? Embracing a green agenda can unlock various financial benefits, from slashing energy bills to commanding premium rents and potentially driving up your property’s valuation. However, making the switch to solar energy isn’t without challenges. A thoughtful assessment is required to determine if it’s the right fit for your property. Let’s explore the broader trend towards solar energy, weigh the pros and cons for HMOs, and determine whether solar panels can truly enhance your investment.

CAN SOLAR PANELS ADD VALUE TO YOUR PROPERTY?

The short answer is yes, potentially. However, this potential appreciation and the decision to install a system for solar energy in your property depends on several factors. If your goal is to future-proof your investment with sustainable practices, you should start by assessing the features, capacity and other elements influencing the added value of solar panels.

The potential property value increase ties directly to a growing demand among buyers and tenants looking for energy-efficient—and more environmentally responsible—housing options. According to research by Admiral, 67% of people looking for a new home factor the EPC rating of the property.

The same market research shows that homes with solar panels sell for 25% more than those without, making them a smart green investment for sellers. Looking to increase property value? Recent studies also signal that adding solar panels could give your property a 4.1% boost.

For landlords, this investment could translate into properties that sell more quickly and at a higher price. On the other hand, rentals leveraging solutions for energy efficiency also stand out, a vital advantage for those in the competitive HMO market.

ESTIMATE HOW SOLAR PANELS INCREASE YOUR PROPERTY VALUE

Calculating the financial uplift that solar panels may bring to a property value is still challenging, even if quantifiable. For example, the increase in value will vary with the location and the energy savings potential of the system installed. So, how can you assess the potential benefits?

- Study the demand in your local market

-

- Analyse recent property sales prices/rents to identify any trends related to solar panels.

- Consider buyer/tenant preferences by assessing the demand for solar-powered houses or accommodations in your area.

- If possible, examine how these sale prices or rents have increased.

- Evaluate the prices of comparable properties in the same area—a method known as Comparative Market Analysis (CMA), which involves

-

- Find properties with characteristics similar to your property in size, location, condition, and features. Selecting the appropriate comparable is critical, as this is the basis of the analysis.

- Analyse the selling prices of properties with and without solar panels.

- Find the average price difference between properties with and without solar panels.

- Estimate potential energy savings based on your solar panel system

-

- Calculate the potential annual energy savings based on your solar panel system’s capacity and local solar conditions.

- Multiply the annual energy savings by a factor to estimate the increased property value. This factor can vary depending on market conditions and buyer preferences.

- Do a solar panel valuation

-

- Determine the cost of your solar panel system, including installation.

- Factor in the system’s depreciation over time.

- Estimate the potential value of the system at the time of sale (residual value).

BENEFITS OF INSTALLING SOLAR PANELS ON RENTAL PROPERTIES

Now, let’s focus on the opportunities for landlords. Installing solar panels on rental properties offers various advantages, from reduced energy bills to potentially higher rental yields, enhanced marketability, and improved property energy performance (EPC).

The annual savings in energy bills through solar panels will depend on the system’s capacity, usage patterns and overall property efficiency. Fortis Electrical & Renewables calculated in 2023 that, for homeowners, the combined savings of monthly bills and the Smart Export Guarantee (SEG) could reach £520 per year.

When it comes to marketability, for eco-conscious tenants, an energy-efficient property is often a deciding factor in their choice of accommodation. This shift in tenant preferences can allow landlords to command a rental premium for offering an environmentally friendly living space.

Beyond the immediate financial benefits, solar panels also contribute to the sustainability credentials of the property, potentially qualifying for various incentives from governments and green initiatives. In terms of your property’s energy efficiency, good systems could add up to 15 points to the EPC rating, according to Solar Fast.

For property investors and landlords looking to cater to a modern, eco-aware tenant base, the potential benefits of solar panels are an attractive investment strategy.

FINANCIAL CONSIDERATIONS FOR HMO INVESTORS: COST VS ROI

Investing in solar panels requires a detailed calculation of initial outlays and long-term benefits. The upfront costs include panels and equipment, installation fees, and potentially upgrading electrical systems to support the new energy source.

Despite these initial costs, the ROI can be substantial. Reducing energy bills alone can lead to significant annual savings, and as solar technology advances and becomes more cost-efficient, it may contribute to a shorter payback period.

Additionally, the potential boost to property value and higher rental income can improve the returns further, making the investment in solar panels for HMO properties a strategy worth considering.

POTENTIAL IMPACT OF SOLAR PANELS ON PROPERTY TAXES AND INSURANCE

While significant improvements can lead to revaluating the property and potentially moving it into a higher Council Tax band, installing solar panels wouldn’t automatically trigger it. Moreover, if the local council offers tax incentives or exemptions for renewable energy installations to encourage their adoption, this can mitigate any increase in property taxes.

Regarding insurance, while having solar panels might slightly increase insurance premiums due to the added value and replacement cost of the panels, this is often offset by the potential benefits, including protection against rising energy prices.

Property investors need to consult with local authorities to determine how incentives apply. It’s also advisable to consult with tax professionals and insurance agents to understand the implications and plan effectively for these financial aspects.

RENTAL MARKET TRENDS AND SOLAR PANELS

The influence of solar panels on the UK property market varies significantly across regions. In areas where sustainability is highly valued, such as urban centres like London or Manchester, properties equipped with solar panels are likely to attract a premium. These installations are seen as an upgrade that reflects a commitment to reducing carbon footprints, appealing primarily to a more discerning and environmentally conscious demographic.

While the impact can be more nuanced in some other areas, the overall trend towards sustainability is growing across the UK, and solar panels are increasingly becoming a desirable feature in both new builds and existing properties.

THE REGULATORY ASPECT OF INSTALLING SOLAR PANELS

The regulatory framework for rental properties, particularly HMOs, is always an element of concern for landlords and investors. In the context of energy efficiency, most domestic solar installations are considered permitted developments (Class A—Enlargement, Improvement, or Alteration of a Dwellinghouse) and do not require planning permission. However, this is subject to conditions and the specific council policies, for instance:

- Installations must not exceed 200mm beyond the roof plane nor be placed above the roof’s highest point (excluding the chimney).

- Special rules also apply for conservation areas and listed buildings, where permissions are stricter to maintain aesthetic consistency.

As standard, consulting with local planning authorities ahead of any alteration is the safest strategy to ensure compliance with any variations and building codes and to avoid legal complications. The regulatory landscape for HMOs is broad and complex, but you can leverage expertise worth more than 630 projects. Get in touch to find out more.

INCENTIVES AND SUPPORT FOR RENEWABLE ENERGY

The UK government has launched various provisional schemes to promote the use of renewable energy, including solar panels. Such incentives can significantly reduce the initial installation costs and enhance the investment appeal of solar panels. For instance, the Smart Export Guarantee (SEG) enables property owners to receive payments for excess electricity exported back to the grid. While the Feed-in Tariff scheme (replaced by the SEG scheme) has closed to new applicants, existing contracts continue to benefit.

Additional support for transitioning to greener energy solutions may be available through different funding and tax rebates, such as reduced VAT on solar installations or grants for installing charge points. Keeping abreast of these incentives can provide substantial financial benefits and contribute to the long-term sustainability of property investments.

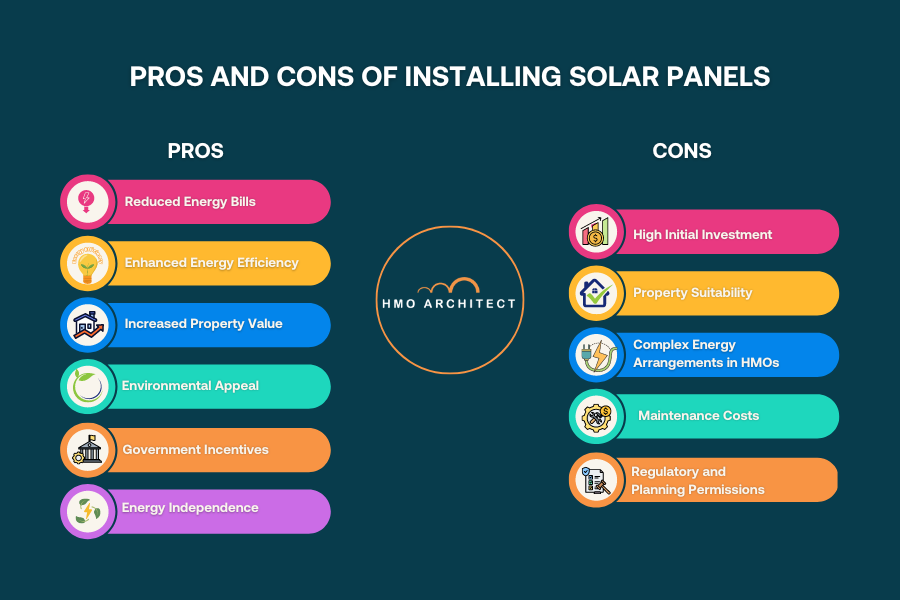

SHOULD YOU PUT SOLAR PANELS IN YOUR HMO? WEIGHING THE PROS AND CONS

Deciding whether to install solar panels on an HMO requires a balanced view of the advantages and challenges. You now know the primary benefits, including reduced energy bills, the potential to increase property values, the appeal to environmentally conscious tenants, and the EPC rating—for which the minimum requirements are likely to increase at some point.

Yet, you need to evaluate the flip side. The initial installation costs can be significant, and not all properties are ideally situated to maximise solar gains—factors such as roof orientation and shading must be considered. Moreover, the complexities of shared energy arrangements in an HMO setting can complicate the distribution and billing of solar-generated electricity.

TO INSTALL OR NOT: WEIGHING THE PROS AND CONS

As with any property alteration or improvement, landlords should align their decisions with their long-term investment strategies and operational capabilities. Here’s a side-by-side overview to help shape that informed decision:

|

Pros of Installing Solar Panels |

Cons of Installing Solar Panels |

|

· Reduced Energy Bills: Solar panels significantly reduce electricity costs, which can be especially beneficial in HMOs where energy usage is typically higher due to multiple occupants. · Enhanced Energy Efficiency: Installing solar panels can improve EPC rating and help prepare for stricter future energy regulations. · Increased Property Value: Properties with solar installations often attract a premium in both sales and rental markets. · Environmental Appeal: Solar panels attract eco-conscious tenants, making properties more desirable and potentially reducing vacancy rates. · Government Incentives: Potential tariff incentives or tax discounts can offset installation costs, making the investment more viable. · Energy Independence: Reduces reliance on grid electricity, protecting against fluctuating energy prices. |

· High Initial Investment: The initial cost of buying and installing solar panels can be considerable, requiring a significant upfront cost. · Property Suitability: Not all properties are ideal for solar panels, with roof orientation, shading, and structure all playing a role in the system’s efficacy. · Complex Energy Arrangements in HMOs: Distributing and billing the solar energy in an HMO can be complex due to multiple tenancies, potentially requiring more administrative effort. · Maintenance Costs: While generally low, solar panels require maintenance and occasional repairs, which could add to the operating costs. · Regulatory and Planning Permissions: Installation may be subject to local planning permission; in some areas, there may be restrictions or additional requirements. |

In HMOs, balancing the cost and benefit of solar energy among tenants can be challenging if individual tenancy agreements differ in terms of utilities inclusion. In addition, HMOs with a high tenant turnover may see a delay to the break-even point for the initial investment—this highlights the relevance of a top-level HMO management strategy.

So, while the initial costs and complexities in the HMO settings can be challenging, the long-term benefits for sustainability, financial savings, and property appeal are compelling reasons to consider solar installations. To get a better chance to maximise the returns, you must consider the property suitability and tenancy agreements in your assessment.

Ryan Windsor, Development Director and co-founder of HMO Architect, brings over 15 years of specialised experience in HMO development to the table. Having consulted on nearly 2,200 projects, Ryan is a highly seasoned HMO landlord with a vast and influential property network. He began his real estate journey at just 17, rapidly amassing a wealth of experience that sets him apart in the industry. Beyond his professional successes, Ryan is passionately dedicated to giving back, leading numerous charitable initiatives that make a meaningful impact on local communities.